They say nothing is certain but death and taxes, except in my case you can also add an annual December scramble to spend my unused HSA/FSA money. At the end of the year I find myself roaming drugstore aisles loading my basket with more Band-Aids, ibuprofen, and allergy meds than the average person needs. Every. single. time.

But it doesn't have to be like this, because there are companies out there that make deciphering and paying for what's HSA/FSA eligible easier, efficient, and even practical, like Truemed for example. Instead of buying a ton of over-the-counter medications that will likely sit in my medicine cabinet until they expire, I can use those HSA/FSA dollars on fitness equipment, gym memberships, and even red light therapy.

Let's dig into how Truemed works and the surprising things you can get with your money to support your health and daily life.

Download The Krazy Coupon Lady app or text HACKS to 57299 for the latest money-saving tips, deals, and coupons.

What does HSA/FSA eligible mean, anyway?

Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) let you take money from your paycheck and set it aside pre-tax to pay for eligible medical expenses that may not be covered by health insurance. When something is HSA/FSA eligible, it means that item or service can be paid for with those funds. While HSA money can roll over from year to year, FSA accounts reset at the start of each year. This means it's a use-it-or-lose-it sitch. However, some employer-provided FSAs might give you a grace period of a few months.

Truemed partners with health-focused companies to make using HSA/FSA money easier, for things that support your well-being.

Truemed is revolutionizing the HSA/FSA game by qualifying premium wellness brands for your pre-tax dollars. Think Peloton, Nike, and top-tier gym memberships — purchases that actually excite you, not just the usual FSA scramble at CVS every December.

Who can use Truemed?

Anyone with an HSA or FSA can tap into Truemed’s services. While some employers directly partner with Truemed (making the process even smoother), you’re not excluded if yours doesn’t. Just check your account guidelines for any specific reimbursement restrictions — most HSA/FSA plans work seamlessly with Truemed’s process.

Before starting your purchase, review your HSA/FSA plan details to confirm eligible spending categories. While most plans are flexible, some may have specific limitations.

The real genius? Truemed handles the paperwork headache, providing that crucial Letter of Medical Necessity that transforms your dream fitness purchases into qualified HSA/FSA expenses. No more hoarding receipts or second-guessing what qualifies — just smart spending on gear you actually want.

7 Surprising Truemed Partners to Shop Using HSA/FSA Money

It felt like a real "Dear Diary" day when I found out what's HSA/FSA eligible at Ulta and Sephora, but this Truemed list is a real game-changer. And this is only a portion of where they can help you spend those hard-earned dollars.

1. HigherDOSE

Approximately 24% of adults in the U.S. deal with chronic pain. If you're one of them, you know how debilitating that pain can feel. HigherDOSE offers products like PEMF Mats, infrared saunas, and red light therapy masks to help ease that pain and inflammation. These are big ticket items, so any savings is on them is a big deal. Truemed estimates you can save an average of 30% on HigherDOSE devices using your HSA/FSA pre-tax dollars. A HigherDOSE Infrared PEMF Pro Mat regularly costs $1,295. Using pre-tax dollars would make it feel more like getting it for $907.

2. Crunch Fitness

If you've ever avoided buying a gym membership because of the cost, Truemed works with Crunch Fitness locations to use HSA/FSA dollars in an effort to offset the expense. Crunch memberships vary in price by location, but you can expect to pay at least $31.99/month if you want flexibility in terms of group class access and no contract commitment. Truemed says on average users save 30% by using their dollars here.

3. 24 Hour Fitness

Much like Crunch, Truemed can help you use your HSA/FSA account to pay for a 24 Hour Fitness membership. Their membership fees vary widely, anywhere from $10 - $30 a month for a basic membership, to $40 - $60 a month for access to every 24 Hour Fitness nationwide. There's also a $60 annual fee all members must pay, except for residents of Hawaii and Nevada. Again, the average savings by using your pre-tax dollars is 30%.

4. Peloton

I personally like the idea of working out in the comfort of my own home more than going to a gym, but every time I consider a Peloton purchase I go into sticker shock. Their equipment has a cult following but, wow, is it expensive. Add this to the list of Truemed partners. Depending on the model of bike you buy, it can cost upwards of $1,300, and that's not including the monthly membership fee to enjoy the classes. By saving an average of 30% using your pre-tax dollars to buy a Peloton through Truemed, that could shave nearly $400 off the price.

5. Nike Strength

If you're looking to kit out a home gym or even just create a small arsenal of fitness equipment to help you work out at home, Nike Strength has everything from dumbbells to weight sleds. Shop Nike Strength through Truemed and save an average of 30% using your pre-tax funds. That means a Nike Dumbbell Tree Set that is regularly priced at $358 would feel more like a $250 spend when buying it with your HSA/FSA money.

6. TRX

Generally more affordable than a Peloton and certainly a better small space option, TRX offers suspension trainers and resistance bands that allow for workouts anywhere. And TRX is a Truemed partner. So let's say you wanted the TRX Pro4 System (regularly $289.95); in theory you could use your pre-tax HSA/FSA money to make it feel more like $203.

7. Apothékary

Interestingly, Apothékary is the first herbal medicine brand to partner with Truemed. Their supplements aim to address stress, sleep, metabolic support, digestion, and more. Most individual formulas cost around $40 apiece. If you're using them monthly, the cost can quickly add up, so using pre-tax money to buy them is a real gift. Saving around 30% would make them seem like a $28 per month expense instead.

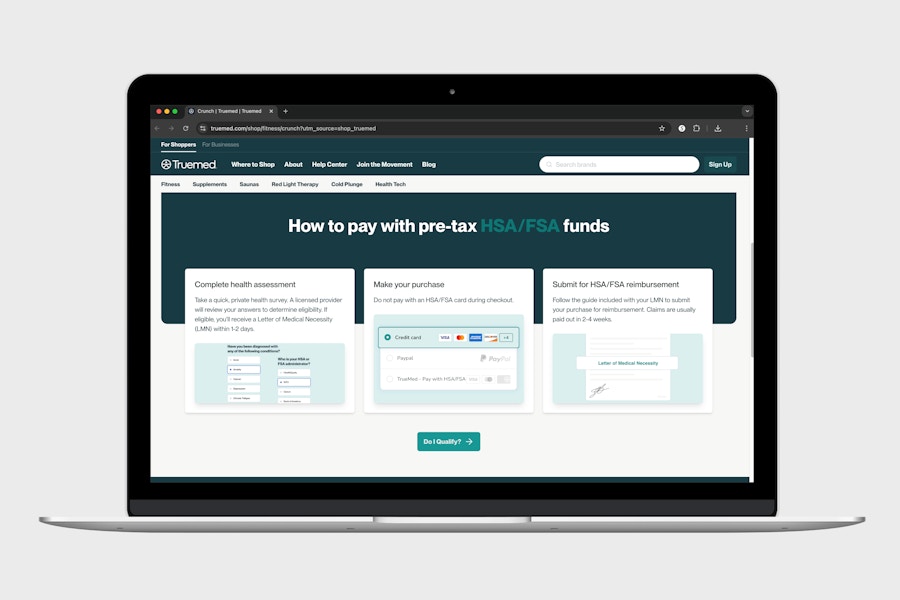

How do you pay with your HSA/FSA through Truemed?

After using the site, it's much easier than I imagined. First, go to Truemed's shopping site. Then click on a vendor on Truemed's website that interests you.

For one-time purchases, do the following:

Select the Truemed Pay option at checkout.

Complete a quick, private health survey to determine your eligibility.

Finish payment with either your HSA/FSA card or a credit card. Note that if you use a credit card, you'll have to follow the instructions on the Letter of Medical Necessity (LMN) provided once approved to learn how to get reimbursed.

For gym membership purchases:

First take the quick, private health survey to determine eligibility and receive your LMN.

Pay with a credit card during checkout (not your HSA/FSA card).

Follow the instructions on your LMN to submit for reimbursement.

Related Reading:

Tell us what you think