Facts: Credit card companies flaunt some pretty persuasive rewards. Also facts: These perks don’t always add up to savings for the card holder. Now that we’ve gotten that out of the way, credit card rewards can be a great way to get you something you desire, and maybe that’s a vacation. But these cards often come with some pretty big red flags. We’re not saying that applies to the Chase Sapphire Preferred credit card, but we’re also not not saying that … yet.

Credit card companies offer rewards programs because, ultimately, they’re profitable. Yes, consumers get rewards, but many of them also incur interest on their purchases. At the end of the day, the interest the bank earns outweighs the perks it hands out.

To ensure you’re not one of the people paying interest, you want to have a steady source of income to pay the bill every month. Don’t spend more than what you can afford to pay off in cash because if you don’t pay your statement in full, you’ll incur interest north of 20%.

If you think you can successfully follow these rules, using credit card rewards to travel might be an option for you. Below we’re looking at one of the most popular credit cards for travel rewards: Chase Sapphire Preferred.

Download The Krazy Coupon Lady app for money-saving hacks and deals sent to your phone.

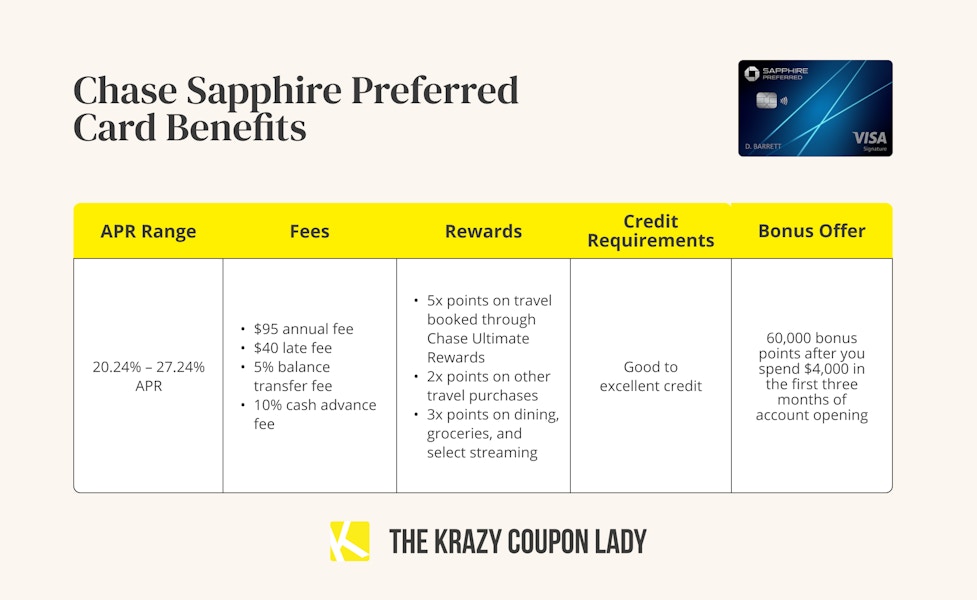

Chase Sapphire Preferred Benefits: An Overview

With the Chase Sapphire Preferred card, you get one point for every dollar you spend. You get three points for every dollar when you spend on dining (whether you’re doing DoorDash or eating in the restaurant), groceries, and select streaming services.

Additionally, you also get two points for every dollar you spend on travel expenses. If you book your travel through the Chase Ultimate Rewards portal, that number bumps up to five points per dollar. That’s where the desired vacation comes into play.

Another perk of booking through Chase’s travel portal is that you’ll get statement credits when you book a hotel this way. These credits can add up to $50 per year.

More about that bonus offer.

Currently, Chase is offering a 60,000-point sign-up bonus when you open a Chase Sapphire Rewards card. To earn it, you have to spend $4,000 within the first three months after you open your account.

They are also running a promo right now where you earn extra points on Lyft purchases through March 2025. You earn two points per dollar as a base since Lyft counts as a travel purchase, and then the promo gives you three more points for each dollar spent. That gives you a grand total of 5x points on your Lyft rides for the next couple years.

This is the best way to redeem Chase Ultimate Rewards points.

Chase Ultimate Rewards points are worth $0.01/each when you redeem them for cash back. But when you use them to book travel through Chase Ultimate Rewards, they’re worth $0.0125, or 25% more.

For example, your bonus offer of 60,000 points would be worth $600 if you redeemed them for cash. But if you used them to book travel, you could squeeze $750 out of them.

Here’s the deal on that APR.

The APR on Chase Sapphire Preferred isn’t outrageous for a credit card, but it’s still high enough that you want to avoid paying it. You can do so by paying off your balance statement in full each and every month.

The APR for both purchases and balance transfers is 20.74% – 27.24%. If you miss even the minimum payment, there’s a penalty APR of 29.99%.

The APR for cash advances is 29.24%.

Related: Check out these 23 cheap places to visit in 2023.

And then the fees.

Unfortunately, Chase Sapphire Preferred does come with a $95 annual fee. And there’s no promo offer that would waive it for the first year.

If you initiate a balance transfer, there will be a fee of $5 or 5% of the balance, whichever is more. Similarly, if you take out a cash advance you’ll pay the greater of $5 or 10% of the cash advance amount.

If you miss a payment or a payment is returned, there is an additional $40 fee.

Your credit needs to be clean as a whistle.

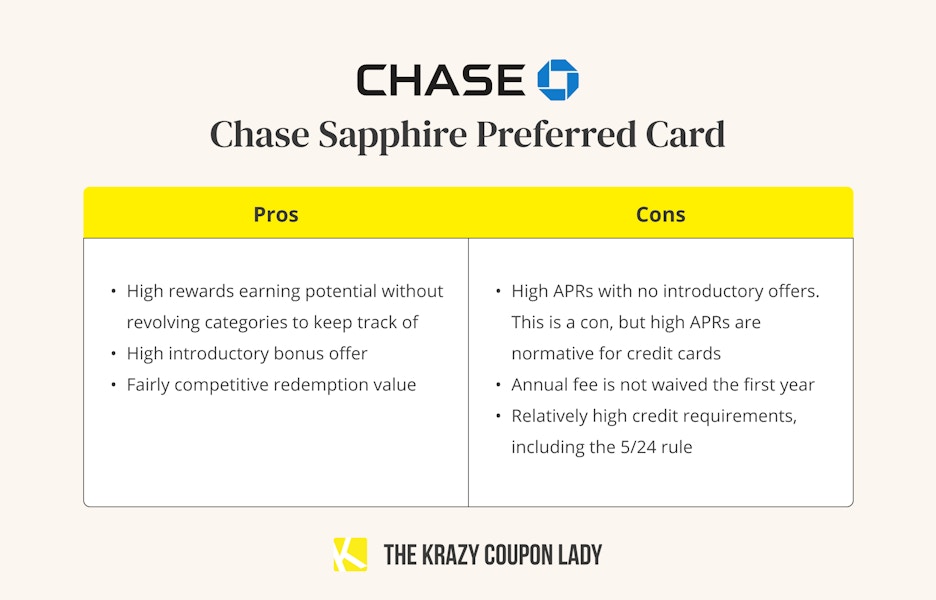

The bar is relatively high for Chase Sapphire Preferred. You have to have a good or excellent credit score to qualify. While we don’t have a firm number, a good credit score is generally considered to have a low end between 670 and 700.

Especially if you’re in this margin, your approval may be influenced by other factors in your credit profile, like any negative marks on your report or a high debt-to-income ratio.

TIP: Chase also has an approval criteria known as the 5/24 rule to prevent credit card churning. It means that if you have opened five or more credit cards over the past 24 months with any bank, you will not be approved for a new Chase card.

Decide whether Chase Sapphire Preferred is right for you.

If you have good-to-excellent credit, Chase Sapphire Preferred can be a good way to earn rewards. This is especially true if you’re a traveler, as you’ll get the most out of your points by booking your trips through Chase Ultimate Rewards.

But it can be a good card to earn rewards even if you’re not a frequent flyer. Getting 5x points on Lyft rides is a pretty great deal, as is a consistent 3x points on groceries and dining experiences.

You will need to be someone who pays their bill in-full every statement cycle, though, as interest charges can negate any rewards earned fairly quickly. Also, make sure you can afford to eat the $95 annual fee up front and every 12 months thereafter.

Even with the annual fee, the bonus offer alone is worth it if you can meet the minimum spend. It’s the equivalent of $600 cash back — or $750 towards your next vacation.

Tell us what you think