Shhhhhh…I’m going to tell you a little secret. Sometimes I use store credit cards. I actually save a lot when I use my credit cards and follow KCL’s 3 Ps of credit. Because you know I’d never, ever recommend you get a credit card unless you could save money doing it!

KCL’s 3 Ps of credit:

Pay that baby off every month without fail. When you do this religiously, you’re not worried about interest rates because you never actually pay them. This is the only way to go!

Purchase only what you can afford with cash. Don’t spend money you don’t have. Ever.

Put the card away. Don’t let it live in your wallet. Make it live in a drawer at home to safeguard against impulse buying.

If you overestimate your ability to honor the 3 Ps, you’ll end up spending way more money than you could save using a credit card. Know yourself and be smart here. If you know you can’t do credit, check out these free store loyalty programs in order to save. No credit required!

Tip: If you’re nervous about getting a store credit card, but you still want to try it, get a card with a “closed loop.” This means it’s only usable at its own store and it’s not an actual Visa or Mastercard you can use anywhere. This might be an extra buffer to keep you on track with KCL’s 3 Ps.

1. Earn an unheard of 10% cash back with your Pottery Barn card.

Annual Fee: $0Interest Rate (APR): 26.99%Closed loop. It’s good only at Pottery Barn stores: Pottery Barn, Pottery Barn Bed and Bath, Pottery Barn Kids, PBteen, and Pottery Barn Outlet Stores.

What rocks? Stinking 10% back in rewards! I love this feature about the Pottery Barn card. You’ll earn $25 for every $250 you spend. You could choose instead to get 12 months, 0% interest financing. Remember, though: only do this if you have a plan to pay the balance off before your year is up or you’ll be stuck with all the interest from your purchase date.

What stinks? In order to get the 12 months 0% financing, you need to spend at least $750.

2. Get 5% back, free shipping, and 30 extra days to make returns with your Target credit RedCard.

Annual Fee: $0Interest Rate (APR): 23.15%Closed loop. It’s only good at Target stores.

What rocks? The 5% back is automatically applied to all of your Target purchases, which adds another level of savings if you’re couponing at Target. It can be used in conjunction with coupons and Cartwheel offers. Learn all the reasons I love Target RedCard.

What stinks? Not much. You can’t get 5% savings at the pharmacy, for gift cards, or for gift wrapping services.

3. Spend over $250 on your Lowe’s card and get 0% interest for 6 months.

Annual Fee: $0Interest Rate (APR): 24.99%Closed loop. It’s only good at Lowe’s stores.

What rocks? Even if you’re not spending up to the $250 threshold for 0% interest, you can still get 5% back on every purchase you make. If you’re remodeling or you just do a lot of home improvement projects, this card offers better savings than competitor home improvement cards.

What stinks? If you don’t pay off your balance in the 6-month period, you’ll be responsible for the interest from your purchase date! Yikes! Also, 6 months goes by fast when you’re making big purchases. Are you sure it’s enough time to pay your balance off?

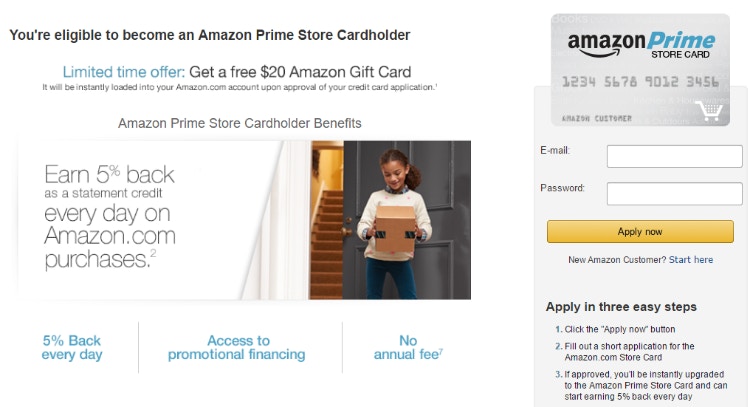

4. Look at your statement for a 5% credit on all purchases made with your Amazon store card.

Annual Fee: $0Interest Rate (APR): 26.24%Closed loop. Only good at Amazon.

What rocks? So many options. You can opt for “promotional financing” of 6 months at 0% interest on purchases over $149, 12 months at 0% interest on purchases over $599, and 24 months at 0% interest on select Amazon-sold items. If you choose to forego promotional financing, you’ll see the 5% kickback applied to your credit card statement.

What stinks? Although there’s not an annual fee, you must be a Prime member to get these benefits from the Amazon store card. If you’re already a Prime member for other reasons, then there’s truly no annual fee. But if you become a Prime member just to get this credit card, you’ll be paying the Amazon Prime annual fee, so for all reasonable purposes, you’re paying an annual fee—although, with benefits! Find out a few secrets about Amazon Prime.

5. Rack up 1% savings anywhere you shop with your Nordstrom card.

Annual Fee: $0Interest Rate (APR): 11.15% – 23.15% based on your credit.Open loop. Use your Nordstrom Visa anywhere Visa is accepted. There’s a closed loop option too! I recommend choosing based on how much you shop Nordy’s.

What rocks? You’ll get 1 point per $1 you spend outside of Nordstrom (2 points per $1 shopping at Nordstrom, Rack, and HauteLook). Once you hit 2,000 points you’ll get a $20 Nordstrom Note. Earn bonus reward points during special promotions.

What stinks? If you don’t shop a lot at Nordstrom, or if your Nordstrom doesn’t have home items, this may not be the best open loop card for you. There are a lot of other Visas with rewards but without the limitation of redeeming them only at Nordstrom.

6. Get 10% off your first purchase and 5% savings on all “T.J. Maxx family” purchases when you use your TJX card.

Annual Fee: $0Interest Rate (APR): 27.24%Open loop. Use your TJX Platinum Mastercard anywhere Mastercard is accepted. There’s also a closed loop option for the TJX card. Choose based on how T.J. Maxx crazy you are.

What rocks? 5 points per $1 spent! The 5% savings on every purchase comes from earning 5 points per $1 spent at T.J. Maxx, Marshalls, Home Goods and Sierra Trading Post. When you reach 1,000 points, you’ll receive $10 to spend at those same stores. Make that first purchase a big one because you get an extra 10% off! Plus, earn 1 point per $1 on purchases everywhere else if you have the Mastercard.

What stinks? Okay, I haven’t said anything so far, and now it’s time. This is a high APR rate!! I mean, they’re all high, but this one is the highest. I don’t need to remind you that it doesn’t really matter as long as you’re planning to pay your balance every month (which you should!), but there’s zero room for error with this card!

7. Score an extra 10% off at Gap on Tuesdays when you use your GapCard.

Annual Fee: $0Interest Rate (APR): 25.24%Closed loop. Use only at the Gap family of stores (including Old Navy, Banana Republic, and Athleta).

What rocks? Lots of perks. Earn 5 points per $1 spent on purchases at Gap and its family of stores (Old Navy, Banana Republic, and Athleta). When you reach 500 points, you’ll receive $5 to spend at the Gap, resulting in 5% savings. You’ll get special pricing on cardholder shopping days. Plus, you can also earn 10% off on Tuesdays when you shop Gap with your GapCard. Get a birthday present and special “choose your own discount” days. Once you have the card, find out how to save the most! Let me get you started with these insider secrets from a seasoned Gap employee.

What stinks? Your points don’t accrue together to be applied to any of the stores. When you have a GapCard, although you earn points through purchases at the other stores in the Gap family, points must be redeemed at the Gap.

8. Get 15%, 20%, and 30% off like crazy when you use your Kohl’s charge card.

Annual Fee: $0Interest Rate (APR): 24.24%Closed loop. Use only at Kohl’s stores.

What rocks? Kohl’s rocks, that’s what. Sometimes I feel like they’re just throwing percentage-off discounts at me. You’ll get 20% off on your first purchase, and then when your Kohl's card arrives in the mail, so will another 15% off! And then you can take advantage of up to 12 yearly 15%, 20%, or 30% off promotions. Want to save even more at Kohl’s? Learn 29 genius (and accurate!) Kohl’s shopping hacks.

What stinks? There’s no actual points system to earn rewards, so it might feel more subjective. I haven’t done a peer-reviewed study or anything, but I have a hunch you might save more money the Kohl’s way. But savings would be harder to track without a points/rewards system.

How do you win at the credit card saving game? Do you still feel a bit gun-shy about taking advantage of credit-based rewards? Tell me your story (and your opinions!) in the “Comments.”

Tell us what you think