If you’re an avid beauty products fan and Ulta shopper, then there’s a case to be made that having the Ulta credit card will be worth it for you. When you make purchases at Ulta using their branded credit card, you’ll earn points faster than standard shoppers do — which means completely free beauty products can be yours even quicker. That alone is worth it.

Of course, if you don’t pay off your balance in full each month, you’ll be smacked with up to 27.49% variable APR (yikes!) on top of your remaining balance. But I’m here to walk you through exactly how the Ulta credit card works, if it’s right for you, and how to use it for maximum savings.

Don’t forget to download the KCL app and set Ulta as your favorite store! We’ll notify you about any new Ulta deals, sales, and promo codes!

1. When you sign up for an Ulta credit card, you’ll get 20% off your first purchase.

When you first sign up for the Ultamate Rewards credit card, you’ll get an Ulta coupon good for 20% off your first purchase. If you go through the credit card approval process online, you’ll need to opt in to Ulta Beauty emails in order to receive your 20% off coupon.

Your status as an Ulta credit card holder will also get you an additional 20% off coupons throughout the year — beyond the standard ones that Ulta releases every three to four months.

Sadly, Ulta doesn’t allow coupon stacking, and they only take one coupon per transaction. So if you think you’re going to pair your 20% off with another Ulta coupon … it’s not happening.

2. Use your Ultamate Rewards Mastercard anywhere.

Ulta offers two different credit cards: a Mastercard-branded card (called the “Ultamate Rewards Mastercard”) and a store-only credit card (called the “Ultamate Rewards Credit Card”). When you first apply for the credit card, it’ll automatically apply for the Mastercard-branded card. If you don’t get approved for the Mastercard option, it’ll then try for the store-only credit card.

If you’re approved for the Mastercard option, you can use this credit card anywhere Mastercard is accepted.

3. As an Ultamate Rewards cardholder, you’ll receive two times the Ulta points.

If you’re already a member of Ulta’s free rewards program, you know that you earn one point for every $1 you spend at the store (and two points for every $1 during your birthday month). But when you have the Ulta credit card, you earn two points for every $1 spent at Ulta. On top of that, if you have the Ultamate Rewards Mastercard, you’ll also earn one point for every $3 spent outside of Ulta, and 500 bonus points when you spend $500 outside of Ulta in the first 90 days.

TIP: When you first sign up for Ulta’s rewards program, set your birthday month to coincide with one of Ulta’s seasonal sales — like March or August during Ulta’s 21 Days of Beauty sale or October during Ulta’s Gorgeous Hair Event. This’ll let you stock up for less and earn double the points, even if it’s not your real birthday month. (Shhh … we won’t tell.)

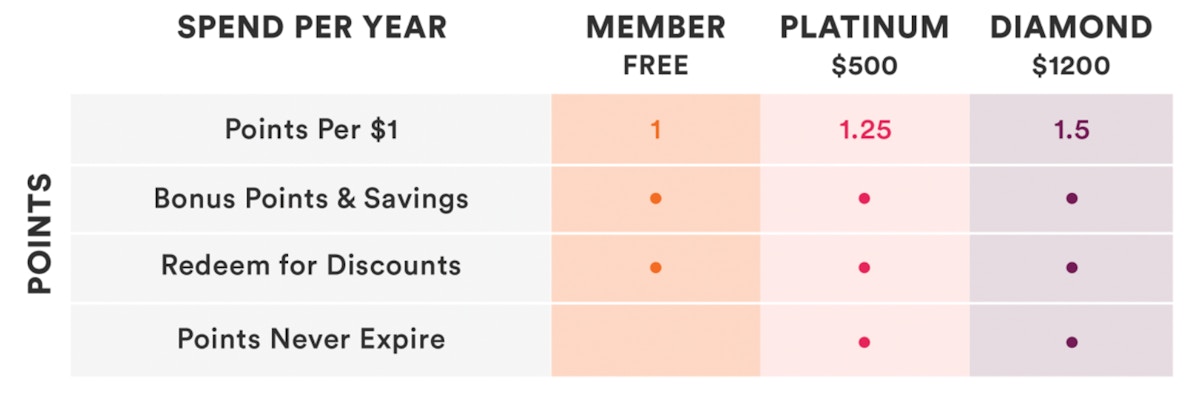

4. The more you shop, the more points you’ll earn.

Since the Ulta credit card is also linked to your Ultamate Rewards account, you’ll get bonus points the same way. If you spend $500 between Jan. 1 and Dec. 31, you’ll earn Platinum status and earn 25% more points. If you spend $1,200 in that same period, you’ll reach Diamond status and earn 50% more points. With both rewards advancements, your points won’t ever expire.

5. Never miss your Ulta credit card payments — Ulta charges up to 27.5% interest and late fees.

Only buy what you can reasonably pay off in the same month. Seriously. According to the fine print, Ulta charges their cardholders a monthly variable interest of up to 27.49%, unless you pay off your balance completely. They also have fees of up to $41 for late or returned payments.

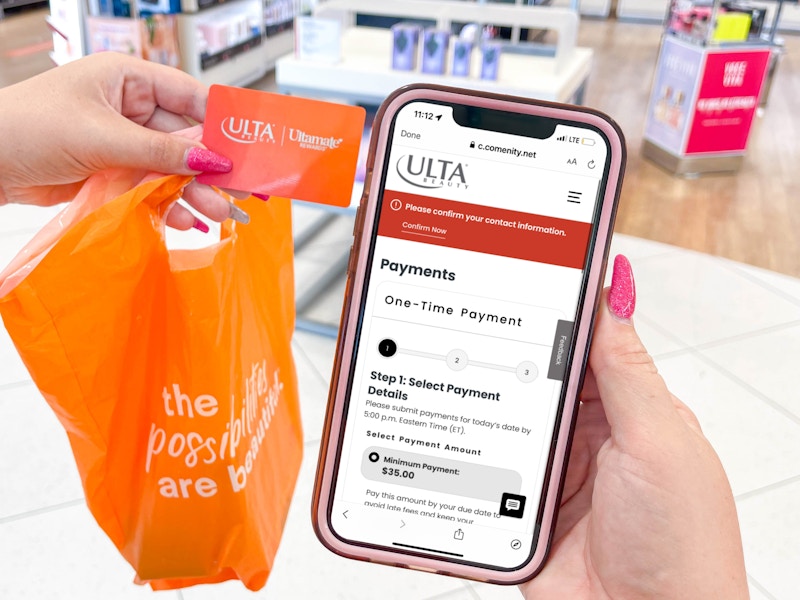

Ultamate Rewards credit card holders have several ways to pay:

Make free online payments on their website. You’ll need to register your account to make your first payment (just select which card you have and enter your 12-digit credit card number, ZIP code, and social security number to find your account). From then on, you’ll just sign in to handle your bill.

Pay over the phone. You’ll need your debit card or your bank routing and account numbers. Call 866-257-9195 and follow the prompts. Fees may apply for payments made over the phone.

Pay by mail. You can mail your payments to Comenity Capital Bank – Ultamate Rewards Mastercard or Ultamate Rewards Credit Card, P.O. Box 650964, Dallas, TX 75265-0964. Be sure to mail your payment in time to arrive before your due date to avoid any late fees.

6. Ultamate Rewards members don’t need a receipt to make returns.

The Ulta return policy is pretty awesome in general. While this is not a perk exclusively for credit card holders, Ulta can look up any purchase made using your Ultamate Rewards member ID number or Ulta.com account. Since your Ultamate Rewards account is linked to your credit card, it’ll make looking up your purchases that much easier.

They’ll process your return as if you’d brought in your receipt. Easy peasy!

7. Leave your Ulta Mastercard at home and use your phone to pay.

If you have the Ultamate Rewards Mastercard, you can link your card to Apple Pay, Samsung Pay, or Google Pay so you can use your phone or watch to pay. Plus, you’ll still earn rewards and benefits when you check out with your digital card.

8. Never pay an annual fee with the Ulta credit card.

There’s no annual fee for either the Mastercard-issued credit card or the Ulta-only credit card. This means if you are able to pay your monthly balance in full each month, you’re basically just earning free rewards points on the money you would’ve spent there anyway.

9. Can you use your Ulta credit card at Ulta in Target?

Yes and no. If you have the Ultamate Rewards Credit Card, you can’t use it at Ulta in Target. It’s only good at Ulta stores.

If you have the Ultamate Rewards Mastercard, you can use it at Ulta in Target. You’ll earn one point for every $3 spent on qualifying purchases, since technically you’re shopping at a non-Ulta store (Target).

Note: You can’t apply for the Ulta credit card at Target or redeem your 20% off first purchase discount at Target.

Tell us what you think