Everyone’s been holding their breath as we await the fate of the Biden Administration’s plan for student loan forgiveness — but while we wait for a Supreme Court ruling, it looks like student loan payments will resume soon, after more than three years paused.

So… Why are student loans now back on?

Well, good things don’t last forever. The government paused student loan payments and froze interest payments during the Covid-19 crisis back in March 2020, and they extended the restart date a few times. Now, as part of the debt ceiling agreement, there won’t be any more extensions for the repayment pause; student loan interest resumed on Sept. 1, and payments will be due starting October 1.

The government has sent letters and emails to borrowers leading up to the restart dates.

The Biden Administration had hoped they’d have fully forgiven your student loan before repayments would resume, but that’s not going to be the case. Instead, they’ve rolled out some new student loan forgiveness plans that will help reduce the amount you owe.

Regardless of any assistance that’s available, it’s important to know where you stand. Find out if and how federal student loan repayments restarting will impact you and what your options are moving forward. Here’s what to do now:

1. If you have an outstanding student loan, prepare to resume payments starting Oct. 1.

If you took out any sort of student loan that wasn’t paid off, you’re on the hook to start your student loan repayment again. You’ll also be on the hook for any fees and accrued interest as well.

It’s also important to note that only federal student loans were in forbearance (a fancy word for “paused”). That means if you have student loans from private lenders, you should have been making monthly payments consistently throughout the forbearance period, because it didn’t apply to you!

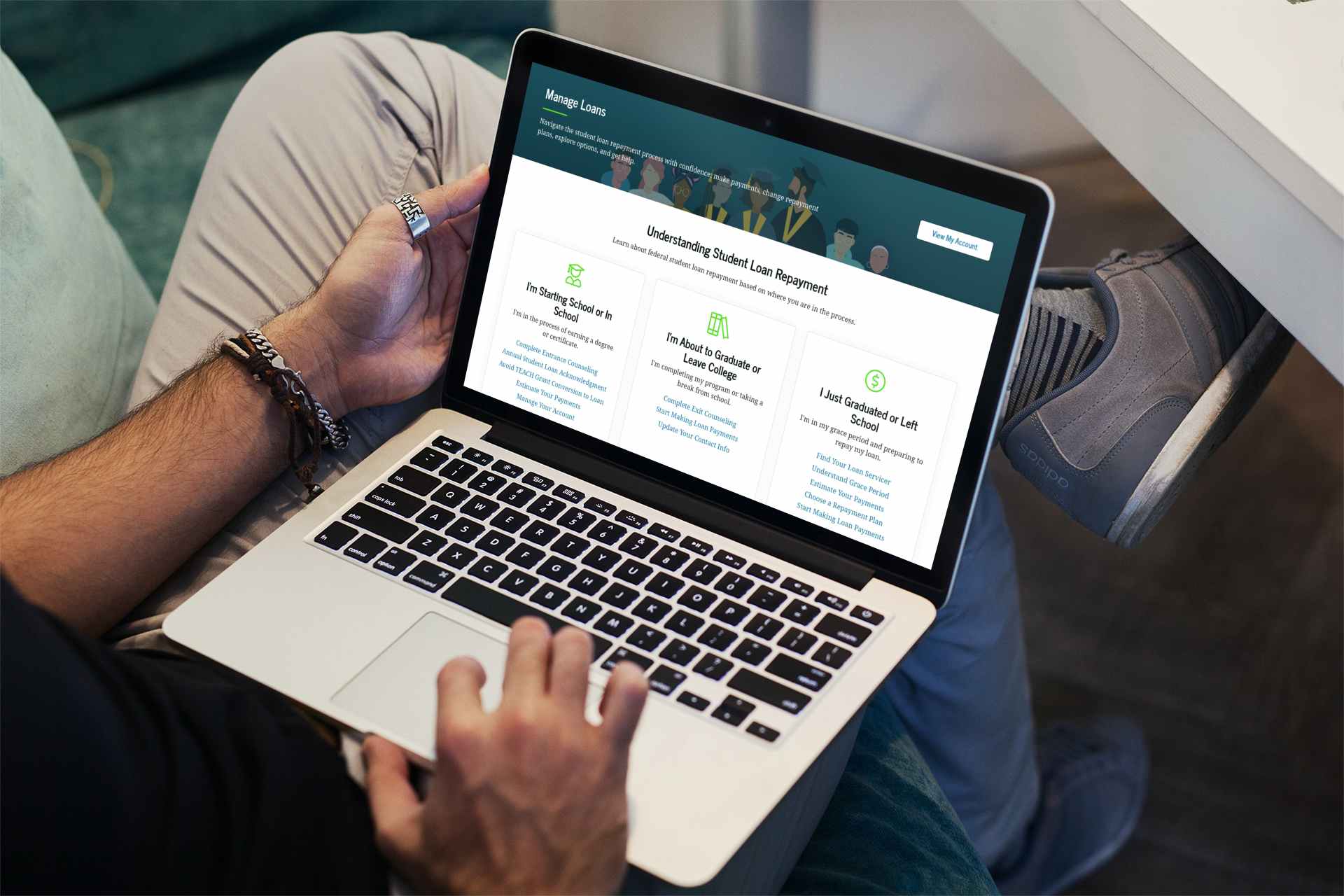

2. Check the Student Aid website to find out how much you still owe on your loans.

To find out how much you still owe on your student loans, log in to your account on the Federal Student Aid website, then go to “manage loans”. Here, you’ll be able to access your remaining balance to find out what you still need to repay, as well as how much interest you owe.

You can also contact your college’s financial aid office to look up your student loan information. This is especially helpful in cases where your student loan servicer may have changed since the pandemic began. And you can also find out how much you owe via free credit reports, which are pretty easy to find.

RELATED: It might be helpful to see if you’ve got settlement money coming your way. Every little bit helps!

3. Public Service Loan Forgiveness Program participants won’t be affected when student loan payments resume.

If you’re a participant in the Public Service Loan Forgiveness (PSLF) program, you’re eligible to get your remaining student debt forgiven after 10 years of qualified work in the public sector and 120 payments.

The PSLF program previously had restrictions that severely limited qualified applicants, but those restrictions actually loosened somewhat from October 2021 to October 2022, allowing more applicants to qualify. You can apply for a one-time adjustment through the end of 2023 by clicking here.

If you haven’t earned your payoff yet, you’re still on the hook for your monthly student debt payments.

4. You can reassess your monthly payment if your situation has changed.

Every individual’s financial situation is different, and your options will vary depending on the type of loans you have, how much you owe, what sort of work you do, what your income level is and whether you’re current and in good standing with your repayments.

- First, you’ll want to find out who your student loan servicer is, because more than 40% have changed hands since the pandemic-era pause began in March 2020. You can find out your federal student loan servicer here or call the Federal Student Aid Information Center (FSAIC) at 1-800-433-3243.

- Once you identify your student loan servicer, you can contact them to find out your balance. From there, you can choose what methods of repayment are best for your individual situation.

- Make sure your contact information is up to date so you don’t miss any notices from your loan servicers or lenders. This is especially important if you’ve moved, changed addresses or started using a new email address.

- Check your repayment options with the federal student loan simulator to see if your current payment plan works with your current income and needs.

Important: An income-dependent repayment plan (IDR) is a type of student loan plan where your monthly payment is based on your income and family size. It caps your payments at a percentage of your spare income, and can forgive leftover debt after 20 or 25 years of payments. Always talk to your loan servicer to see if it’s right for you.

5. If your student loan is in default, you might be able to get a ‘Fresh Start’.

So, if you’ve missed some student loan repayments and you’re in default, you could qualify for this thing called the federal Fresh Start program, which lets you resume repayments “in good standing” after the break. Here’s what you need to get in:

- Your student loans must be federal, like direct loans, government-held Perkins loans, government-held FFELP loans or even privately held FFELP loans. Sadly, if your loan’s a private one, Fresh Start isn’t gonna work for you.

- You need to have tripped up on your federal student loan repayments, meaning you defaulted, before the whole forbearance thing started in March 2020.

Tell us what you think