You have to be super careful when you open your first credit card. It’s important to fully understand the implications of paying interest and how missing payments can hurt your credit score and ability to borrow money at affordable rates for years to come. Plus, there’s all the consequences of consumer debt on top of those student loans you’re probably carrying. That’s why finding the best credit cards for college students is important to start off on the right foot.

Once you’ve done your due diligence to learn the basics, getting your first credit card can be a challenge. Lenders aren’t necessarily clamoring to take a chance on an unproven, broke college student. And when they are? There’s a good chance they’re trying to take advantage of your inexperience with financial products.

We’ve rounded up some of the best credit cards for college students, whether you have zero credit history or your score’s gotten a little bump with mom and dad’s help. Just make sure you know how to use these cards responsibly so you don’t ruin your financial future from the get-go.

TIP: Download The Krazy Coupon Lady app to get updates on things like student discounts.

How to build credit as a college student.

If you’re a college student trying to build your credit history up from zero, there are usually two main paths available to you: get added as an authorized user on your parents’ card or get a secured card.

If your parent or anyone else adds you as an authorized user, make sure you’re doing your part to pay for your own expenses. It’s not just a jerk move to leave them holding the bill; if they can’t afford to pay it, this will negatively impact both your credit and their credit.

A secured card is like a credit card on training wheels. Instead of borrowing against the bank’s money, you’ll pay the bank a deposit. Say, $500. Then you’ll borrow against your own $500.

As long as you’re making on-time payments every month and the bank reports your payments to the credit bureau, this tool can help you build a positive credit history. Eventually, you could get approved for a full-fledged credit card.

TIP: Credit cards aren’t the only way to build your credit. In fact, they shouldn’t be the only way you’re building your credit. Your credit mix is a big part of your credit score, and it requires both revolving debt like credit cards and term loans like car notes.

Best Secured Card for College Students: Capital One Platinum Secured Credit Card

The Capital One Platinum Secured Credit Card can be a good choice for students because you don’t need much cash on hand for your initial deposit. Your approved credit line can range anywhere between $200 and $1,000. For the $200 line, you only need a deposit of $49, $99, or $200, depending on your personal credit profile.

Don’t worry, you don’t need a credit card or even a credit history to qualify for this one. But another part of your credit profile includes your personal income. Capital One will look at your debt-to-income ratio before approving you for this card.

If you’ve never had debt in your name before, no big deal! But you will still need some type of income to qualify.

The difference between a student credit card and a regular credit card

In limited circumstances, there are student credit cards available on the market. These cards are more likely to accept you if you have zero credit history, but they’re more likely to approve you if you have at least a little bit.

Student cards tend to have lower lending limits than traditional credit cards.

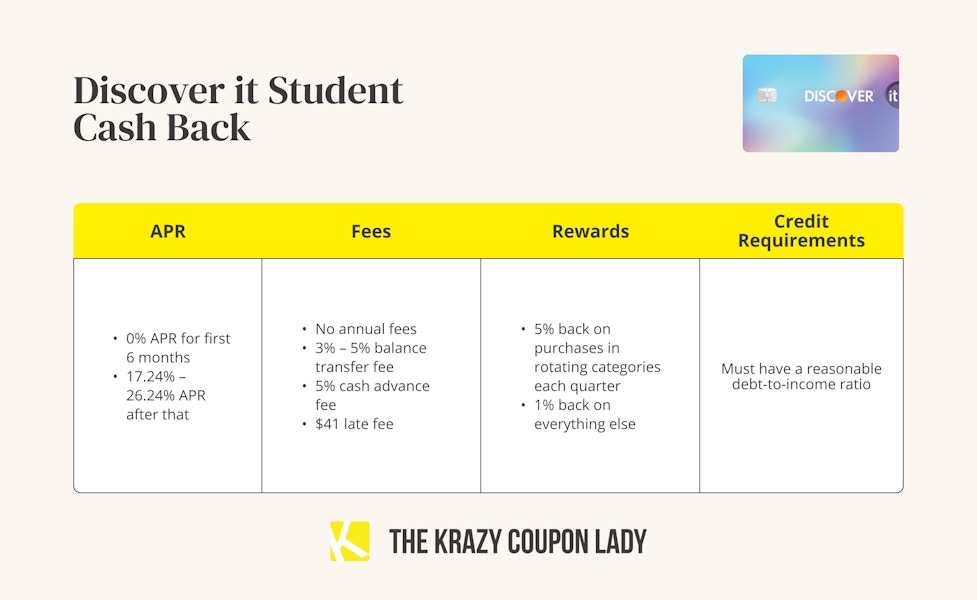

Best Credit Card for College Students With no Credit History: Discover it Student Cash Back

The Discover it Student Cash Back card is one of the rare few credit cards that doesn’t necessarily require credit history. It offers introductory APRs, depending on how you’re using the card:

Purchases: 0% APR for first 6 months, then 17.24% – 26.24% APR

Balance Transfers: 10.99% APR for the first 6 months, then 17.24% – 26.24% APR

Cash advances: 29.24% APR with no introductory offer

Plus, you’ll actually get rewards with this card. In fact, you receive 1% cash back on most purchases. Every quarter, Discover gives you a rotating category or four where you can earn 5% cash back.

To make the deal even sweeter, Discover now matches the cash back you earned over the first 12 months on your card’s 1-year anniversary. So your rewards double.

The rewards and low credit requirements make this our favorite student card for those with thin credit history, but it is still a credit card. You do still want to avoid paying interest at all costs. Don’t ding up your brand-new credit history with negative line items like late payments.

TIP: Both Discover and Capital One offer refer-a-friend programs that can help you make money.

Most student credit cards do require some credit history.

The Discover it Student credit card is a unicorn. Most credit cards (even student credit cards) do require at least a little credit history.

If you’ve already got a leg up thanks to a couple years as an authorized user on your parents’ card or an auto loan you paid off in your own name as a teen, more options open for you.

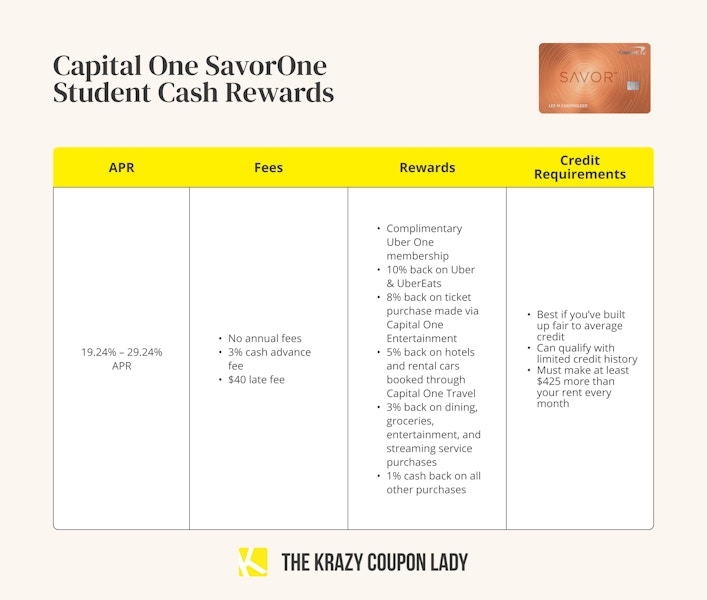

Best Rewards Card for College Students: Capital One SavorOne Student Cash Rewards

If you’ve built up a little bit of a credit history, you can earn more with Capital One’s SavorOne Student credit card. This is especially true if you go to a lot of concerts or order UberEats, like, all the time.

SavorOne’s cash-back categories have very specific tiers, but they don’t rotate every quarter like they do with Discover. So once you learn them, they’re easier to keep track of, making it among the best credit cards for college students.

While you can technically qualify for this card with a limited credit history, you’re likely to be offered better rates if you have a fair-to-average credit score or better. “Fair” credit scores tend to start somewhere around 580 but can also be considered to start in the mid-600s.

A higher credit score is one thing that will help increase your odds of approval, but another big factor is your monthly income. You need to make at least $425 more than your rent every month for Capital One to even look at you, which might be a big ask for some college students.

Paying for Study Abroad

When you’re studying abroad, you’ve likely got your room and board covered by your grants, scholarships, or student loans that were already paying your tuition at your home school.

But once you’ve reached your destination, you’re going to want to spend some time exploring. If you’ve built up a strong enough credit history, you can use travel rewards cards to fund your excursions — whether you’re taking a flight or booking a train.

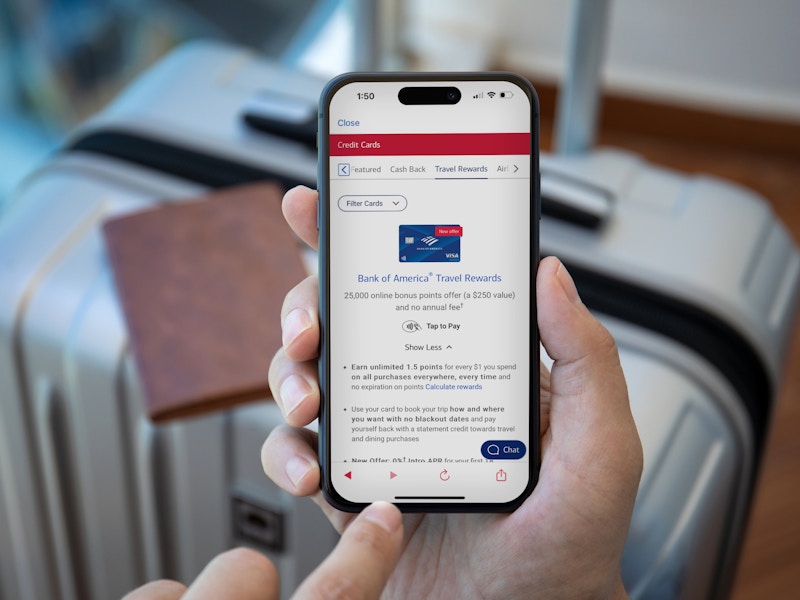

Best Card for Study Abroad: Bank of America Travel Rewards Credit Card

Travel hacking can get complicated — especially if you’re overseas. That’s why we like the Bank of America Travel Rewards card for study abroad. You can use your points for any travel purchases without being tied to a specific airline or hotel chain.

You’ll get 1.5 points for every dollar you spend. Points are worth $0.01/each, so that’s the equivalent of 1.5% cash back on every purchase. But you can only use your rewards to offset travel purchases you made with this card.

Right now, there is a 25,000 point bonus when you spend at least $1,000 on your card within the first 90 days. That comes out to a statement credit of $250. It’s not the largest one out there, but the minimum spend is low enough that it may be achievable for a college student.

To qualify for this card, you will need a good-to-excellent credit score. Most financial institutions consider a minimum score between 670 and 700 to be good, so you’ll want to shoot for that range or even higher.

Technically, there is a student version of this card that may have more lenient lending standards. But it doesn’t come with the 25,000-point sign-up bonus.

Tell us what you think