Did you know your HSA and FSA can pay for so much more than copays and prescriptions? A Health Savings Account (HSA) or Flexible Spending Account (FSA) can give you one of the best tax advantages out there. You can use HSA/FSA funds to pay for healthcare and medical expenses tax-free, and there are tons of items that fall into the category of eligible expenses.

I dug into the full list of HSA- and FSA-eligible products and was shocked to find items I never thought would qualify. You can buy things like sunscreen, acne treatments, reading glasses, and even prenatal vitamins with your HSA or FSA card — no questions asked. It’s way more than just ER visits, X-rays, and eye exams.

Check out this list of more than 40 unexpected items you can buy with your HSA or FSA funds. You can even shop for higher-end products at Ulta or Sephora or buy your HSA/FSA items at Costco. And stretch those tax-free dollars even further by clipping digital coupons and store offers before you shop.

For more smart shopping tips and savings hacks, download The Krazy Coupon Lady app.

Can I buy anything with my HSA or FSA?

Not exactly. You can only use your HSA or FSA on qualified medical expenses, aka products and services designed to ease or prevent physical or mental illness.

Lots of basic health and hygiene products qualify, but they’re all within reason. Like, you can’t use your HSA or FSA to pay for an all-inclusive trip to Maui and claim it’s for mental health (as awesome as that’d be).

Here’s how the IRS defines a qualified medical expense in IRS Publication 502:

“Medical expenses are the costs of diagnosis, cure, mitigation, treatment, or prevention of disease, and for the purpose of affecting any part or function of the body. These expenses include payments for legal medical services rendered by physicians, surgeons, dentists, and other medical practitioners. They include the costs of equipment, supplies, and diagnostic devices needed for these purposes.“

What are some HSA- and FSA-eligible expenses in 2024?

An HSA or FSA card can be used to pay for thousands of health and hygiene products, including household staples you probably buy on the regular. Over-the-counter medicine, first-aid supplies, sun protection, and feminine hygiene products are just a few of the HSA- and FSA-eligible expenses in 2024. Products you use for mobility and other physical disorders are also eligible, like walkers, wheelchairs, CPAP machines, and much more.

The IRS also added items used for COVID-19 prevention to the list of qualified medical expenses, so now you can use your HSA or FSA to buy things like face masks and hand sanitizers in 2024.

KCL TIP: Before you start a huge HSA or FSA spending spree, always check with your provider to confirm your purchases are eligible. Use this list of HSA- and FSA-eligible expenses as a guide for which items qualify.

40+ Surprising Things You Can Buy With an HSA or FSA Card:

1. BinaxNOW COVID-19 Self Test

Test at home easily with BinaxNOW™ Covid-19 self-tests you can pick up at Walmart, CVS, Walgreens, and Rite Aid. Right now, you can save up to $7 on a 4-count pack or $4 on a 2-count pack with an Ibotta offer at select retailers.

Walmart

CVS

Walgreens

Rite Aid

Consumer and Retailer: LIMIT 1 COUPON PER PURCHASE PER PRODUCT SPECIFIED AND QUANTITY STATED. Cannot be combined with other offers. LIMIT OF TWO (2) IDENTICAL COUPONS IN SAME SHOPPING TRIP. Void if expired, altered, reproduced, copied, sold, transferred, taxed, restricted, exchanged to any person, firm, or group prior to store redemption, or prohibited by law. Any other use constitutes fraud. Good only in USA and territories. Cash value 1/100¢. Consumer pays sales tax. Retailer/Clearinghouse: By submitting, you agree to Abbott’s Coupon Redemption Policy (available upon request). Abbott will reimburse you face value of coupon (or actual retail price of item if less) plus 8¢ handling. Send to Inmar Brand Solutions Dept. 70074, Mfr Rcv Office, 801 Union Pacific Blvd Ste 5, Laredo, TX 78045-9475. Pharmacists/Retailers: Coupon not valid for product reimbursed, in whole or part, under Medicare, Medicaid or similar federal or state government programs. Abbott Nutrition participates in the CIC Member Coupon Integrity Program.

FDA Emergency Use Authorization

These Ibotta rebates are available until Nov. 30 but may end sooner if the redemption limit has been met. It's better to shop sooner than later to secure your savings while the offers are available.

2. Depend Adult Underwear

Yep! Depend Adult Underwear and other bed-wetting aids are HSA- and FSA-eligible. Even better, you can often earn cash back on Depend with Ibotta when you shop at Walmart.

See all the current Depend coupons and offers.

3. Poise Pads and Liners

Say goodbye to overspending on feminine hygiene. Poise pads and liners are considered eligible medical expenses, so it’s always a good time to stock up. Even though your FSA or HSA will cover these items, you can buy Poise products for less than $0.50 a pad at Walmart.

See all the current Poise coupons and deals.

4. Laxatives

Laxatives are also eligible for reimbursement — and it’s a great time to stock up on Dulcolax at stores like Target and Walgreens, where they have digital store coupons available to clip.

See all the current Dulcolax coupons and deals.

5. Pain Relief Cream

Pain relief creams and treatments — like those from Icy Hot and Aspercreme — are often eligible for HSA and FSA. With the end of the year approaching pretty quickly, now's the time to stock up — lots of retailers have deals on medicine cabinet essentials at the end of the year for this exact reason.

Want an even sweeter deal? If you make a $40 (pre-tax) purchase of select pain creams by Dec. 21, you'll also get to choose a $10 reward* and earn an entry for a Wellness Getaway sweepstakes. Plus, you'll find a handful of wellness coupons through your local newspaper, Target Circle app, Ibotta, and more.

Here's how to get your $10 reward.

Purchase $40 (before tax) or more of participating products in one transaction online or in store between Nov. 3 and Dec. 21.

Take a photo of your entire receipt showing the qualifying items starred or take a screenshot of your shipping, pickup, or delivery confirmation and upload to www.activaterewards.com/medicinecabinet by Dec. 21.

Receipt submissions will be reviewed within 2 to 5 business days. Once validated, you'll receive an email with a link to choose your reward as well as an entry into the sweepstake for the wellness getaway.

This $10 reward isn't only available for pain relief creams, it's valid on hundreds of wellness products at retailers nationwide. See our deal post for a list of all eligible items and available coupons in this Spend $40, Get $10 promotion.

6. hear.com Hearing Aids

Instead of waiting the average of five to seven years before trying on hearing aids and letting your hearing get worse, you can use your tax-free HSA/FSA funds for hearing aids at hear.com.

You can get a 45-day trial in select states and save 40% off Horizon AX devices as a KCL reader.

7. Sunscreen (SPF 15+)

As long as it has an SPF of 15 or higher and broad spectrum protection against UVA/UVB rays, sunscreens qualify as an HSA or FSA purchase. That means you can stock up on sunscreens for babies, kids, and adults — even from pricier brands like Neutrogena, Sun Bum, Banana Boat, and Supergoop.

See all the current sunscreen coupons and deals.

8. Acne Treatments and Cleansers

You can buy some of your most-loved face cleansers, gels, and astringents with your HSA or FSA card. Brands like Neutrogena, Clean & Clear, Aveeno, and La Roche have products that qualify, like Neutrogena’s famous Pink Grapefruit Oil-Free Acne Face Wash ($11.39 at Target).

See all the latest coupons for acne products:

9. Pain Relievers

You can use your HSA to buy lots of over-the-counter pain relief staples, like Advil LiquiGels, Tylenol, IcyHot patches, Excedrin Extra Strength, and many more.

See the current over-the-counter medicine savings:

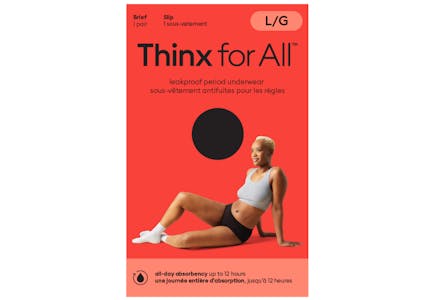

10. Thinx Period Underwear and U by Kotex Pads

It's true — no more pink tax! Like tampons, pads, and liners, period underwear is covered by your HSA/FSA! Thinx underwear, $16.98 a pair, comes in various styles and absorbencies, so you can select the right match for your body and flow. They're 100% reusable and machine-washable (up to 30 times), making Thinx period underwear a great choice for those looking to reduce waste.

Thinx Teens Period Underwear is designed with a core layer that can absorb flow (up to three regular pads worth). Like the all-women’s style, Thinx Teens period underwear provides up to 12 hours of protection against leaks.

For up to 12 hours of overnight protection, you may want to consider U by Kotex Balance Ultra Thin Pads with Wings. In addition to leakproof protection, these pads have a charcoal core to prevent odors.

If you’re looking for an alternative to traditional pads, these products may be what you need.

See all feminine hygiene coupons available now.

Related: Looking to save more on feminine supplies? Sharpen your skills with our ultimate guide to saving on tampons and pads.

11. Allergy Medicine

Allergy meds can be pricey, but using tax-free dollars to pay for them can help. Over-the-counter allergy medicines from Zyrtec, Benadryl, Claritin, Xyzal, Allegra, and more are HSA-eligible expenses.

See all allergy coupons available now.

12. Cold & Flu Medicine

You can charge cough drops, syrups, tablets, and other over-the-counter cold and flu meds to your HSA or FSA. Products from Theraflu, Zicam, Mucinex, and Cold-EEZE all qualify as eligible expenses.

13. Hand Sanitizers

The IRS recently added products that protect against COVID-19 to the list of qualified medical expenses, which means you can buy them with your HSA or FSA. Keep in mind that only hand sanitizers that contain at least 60% alcohol qualify.

See all hand sanitizer coupons available now.

14. Face Masks

Face masks are now an HSA- and FSA-eligible expense, too. Disposable pediatric masks and N95 respirator masks both qualify as purchases.

15. At-Home COVID-19 Tests

If your health plan covers the full cost of at-home COVID tests, you can buy them with your HSA or FSA.

Check out these other ways to save on at-home COVID-19 tests.

16. Thermometers

You can use your HSA to buy all types of thermometers for babies, kids, and adults. Thermometers from brands like Braun and Vicks are HSA- and FSA-eligible.

17. Epsom Salt

Yup! Epsom salt has a variety of health benefits, so it’s considered a qualified medical expense with your HSA.

18. Rubbing Alcohol

Your HSA is good to use on rubbing alcohol, too. The best part? Rubbing alcohol serves multiple purposes beyond its medical benefits.

19. Reading Glasses

Reading glasses are just one of the many eye care products that qualify as an HSA or FSA purchase. Look for deals at drugstores like Walgreens or even at the Costco Optical Center to save more.

Related: Don’t miss our full list of things you should always buy at Walgreens.

20. Eyeglass Wipes and Repair Kits

You can buy everything you need to keep your glasses in tip-top shape with your HSA or FSA. Repair kits, wipes, and cleaning sprays are all eligible purchases.

21. First Aid Bandages and Kits

Most first aid supplies for cuts, wounds, and minor injuries qualify as medical expenses. That includes Band-Aids, gauze pads, ace bandages, deluxe first-aid kits, and more.

See all the latest Band-Aid coupons.

22. Antibiotic Creams and Ointments

Yes — Neosporin counts as an HSA- and FSA-eligible expense! Other wound care products from Bactine and Nexcare also qualify.

23. Contact Lenses, Cases, and Solutions

You’ll need a prescription to purchase contact lenses with your HSA or FSA, but other related products like contact lens solutions and lens cases are always eligible.

24. Baby Rash Ointments and Cream

You can buy creams for diaper rashes and other baby skincare products with your HSA or FSA. Brands like Cortizone, Cetaphil, Desitin, and Aveeno Baby have products that qualify.

25. Nursing Bras and Supplies

Don’t buy nursing bras unless it’s with your HSA! Other nursing products like breast pumps and breast milk storage bags and bottles are also HSA-eligible.

26. Baby Breathing Monitors

Baby breathing monitors can bring you some peace of mind, and luckily, they qualify as an HSA expense.

27. Pregnancy Tests and Ovulation Monitors

Pregnancy tests can be pricey, but you can buy them with your HSA. You can buy at-home fertility tests and ovulation monitors with your HSA, too. Look for deals at Target and CVS to save more.

28. Prenatal Vitamins

You can buy prenatal vitamins with your HSA since they, too, qualify as a medical expense. Products from brands like Vitafusion, One A Day, and Nature’s Bounty all qualify.

Check out these vitamin coupons you can use right now.

29. Condoms and Contraceptives

A variety of condoms from Trojan, Durex, and LifeStyles all qualify as HSA-eligible expenses.

30. Insect Bite Creams and Ointments

Stop all that scratching and pick up some itch relief cream or gel at your nearest drugstore. You can buy After Bite, Benadryl itch relief, and Eucerin calming lotion with your HSA.

See the latest deals on ointments:

31. Nicotine Gum and Patches

Products that are made to help you quit smoking are also HSA- and FSA-eligible purchases. Nicorette Gum and NicoDerm patches are both qualifying products.

32. Compression Socks

Compression socks are pricey but necessary for certain medical conditions. Luckily, compression socks from brands like VIM & VIGR and Skineez qualify as an HSA purchase.

33. Sleep Aids

Catch some more z’s with a variety of HSA-eligible products, like Unisom SleepGels, Vick’s ZzzQuil, and Motrin PM.

See the latest sleep aid deals:

34. CPAP Machines

If you have obstructed sleep apnea, you likely have or need a CPAP machine to help you sleep. Most CPAP products qualify as medical expenses, so you can use your HSA to buy CPAP machines and CPAP cleaning supplies as needed.

35. Teeth Grinding Prevention

Think mouthguards, retainers, and denture cleaners. These products are all HSA-eligible expenses.

36. Nasal Strips and Sprays

Can’t shake that stuffy nose? No problem. You can buy nasal strips, sprays, and aspirators with your HSA.

37. Digestive Aids

An upset stomach can put a wrench in your plans. Use your HSA to buy qualified digestive aids like TUMS, Alka-Seltzer tablets, and MiraLax solutions.

38. Eczema Treatments

Your HSA is good to pay for soothing creams and lotions made for Eczema relief. Buy eligible products from top brands like Aquaphor, Cerave, and Cortizone.

39. Ear Drops and Wax Removal Products

Tons of earwax removal kits and cleaners are qualified HSA or FSA purchases. Even the Wax Blaster MD Pro (regularly $7.99) is on the list of eligible products.

40. Footcare and Arch Support

Keep your feet healthy, clean, and pain-free with HSA-eligible foot care products. Foot rollers, Dr. Scholl’s insoles, callus removers, and athlete’s foot treatments are all qualified HSA purchases.

41. Lumbar Support

If your back pain gets in the way of everyday activities, you can shop a variety of HSA-eligible products to help, like back braces and decompression belts.

42. Crutches, Wheelchairs, and Walkers

Purchases like these come at a steep price, but you can use your HSA to pay for them. Mobility products for injuries and disabilities are qualified medical expenses, so you can buy canes, crutches, wheelchairs, and walkers with your HSA.

43. Braille Books and Magazines

The IRS is adding more products for people with disabilities to the list of qualified medical expenses. Right now, you can use your HSA to buy a variety of braille books, magazines, and other reading materials, as long as they cost more than the regular printed editions.

44. Home Diagnostic Tests and Kits

Think blood pressure monitors, test kits for diabetes, and personal EKGs (like this KardiaMobile Personal EKG Monitor for $109 on Amazon). These types of at-home health products are HSA-eligible expenses.

45. Motion Sickness Medications

Your HSA is good to use on motion sickness products like Dramamine, Bonnie tablets, and Sea-Bands.

46. Canker Sore Treatments

Canker sores can crush your dreams for a week or so, but you can buy tons of medicated gels and treatments with your HSA.

Use these Orajel coupons on your purchase to save more.

47. Athletic Braces and Mouthguards

Athletes get to reap the HSA benefits too. Tons of products for joint and muscle pain relief are HSA-eligible, like athletic tape, joint wraps, ankle braces, and more.

These products are HSA-eligible with a Letter of Medical Necessity:

Air Conditioners

Air Purifiers

Aloe Vera

Cocoa Butter

Baby Formula

Exercise Equipment

Ergonomic Chairs

At-Home Drug Tests

Tell us what you think