Buy now, pay later. . . not that long ago the only ways to do that required a credit card or setting up layaway. Not anymore.

Now, a number of new companies are disrupting the way we pay for our purchases. They’re making it possible and easy for us to buy what we want now, but pay later in installments, without the interest you get from credit cards or the limits of layaway that you’d get in stores.

With Buy Now Pay Later apps and websites shoppers can complete a transaction — in-store or online — and divide the total into at least four equal payments: like layaway 2.0.

For more smart shopping tips and savings hacks, text HACKS to 57299.

How is “Buy Now, Pay Later” different from layaway?

This is better than layaway, people. With layaway, you put a deposit on an item, make payments, and pick it up once you pay off the balance.

With Buy Now, Pay Later you can take home the item before you’re done making payments. That really helps for big-ticket purchases and unexpected expenses.

Like with layaway, you can still do returns, avoid interest payments, and not totally tank your bank account.

Here are the services doing Buy Now, Pay Later:

1. Apple Pay Later launched on iOS devices in March 2023 with no interest or fees.

Everyone expected this new Apple feature to come out with the release of iOS 16 in the fall of 2022. But after a small delay, Apple launched Apple Pay Later on March 28, 2023, to “select users” first, with a full rollout planned for the coming months.

Instead of having to “pay in full” when you use Apple Pay, the new Apple Pay Later feature lets you split your purchases of at least $50 (and up to $1,000) into four interest-free payments spread out over six weeks.

The first payment is due immediately, and the rest of the payments are due every two weeks. This new payment option will be accepted anywhere that accepts Apple Pay.

There will be a soft credit check to join Apple Pay Later, but it won’t affect your credit score. To see if you have the feature, check your Apple Wallet.

2. Afterpay lets you buy now, pay later at airlines, physical and online retailers, and independent sellers.

Look for Afterpay as a payment option during checkout at your favorite online store — and now that the company is part of Square, you can buy now, pay later with thousands of independent sellers who take Square payments. If you set up an Afterpay Card in the app, you can even use it to pay in certain stores.

Sign up for an Afterpay account to place online orders up to $1,000 and split the cost into four payments, due every two weeks. There’s no credit check and no fees as long as your account has enough funds when the split amounts are automatically taken out.

Popular retailers who accept Afterpay in stores:

- Alex and Ani

- American Eagle

- Anthropologie

- Dick’s Sporting Goods

- DSW

- Finish Line

- Gap

- J.Crew Factory

- lululemon

- Michael Kors

- Nordstrom

- Nordstrom Rack

- Old Navy

- Pacsun

- Pandora

- Sephora

- Sketchers

- The Children’s Place

- Ulta Beauty

- Urban Outfitters

If a certain retailer you like doesn’t have Afterpay functionality at checkout, look for an Afterpay gift card, which you can pay off in four installments. They’ve also partnered with online airfare marketplace Alternative Airlines — letting you divide the cost of airline tickets into four payments, due every two weeks. This is a BIG deal for travelers!

TIP: Earn perks like money-off coupons for paying on time with Afterpay’s reward program.

3. Klarna lets you buy now and pay later at any online store with their ‘Ghost Card.’

Retailers like Macy’s started accepting Klarna as a payment option at Macys.com, and it’s got people asking, “What is Klarna?” and “How does Klarna work?”

Klarna lets you divide purchases into four payments at any online store — not just Klarna stores — when you shop your favorite websites through the Klarna app.

At checkout, Klarna gives you a “ghost card,” or a credit card number good for the predetermined purchase amount. Your first Klarna payment is due the day of purchase, then you make additional payments every two weeks automatically with the credit or debit card you have on file.

There’s no credit check (unless you opt for longer-term financing), interest, or late fees. Keep up with timely payments, or they’ll decrease your limit for future purchases.

TIP: Klarna also has a loyalty program, where you accumulate “vibes” — $1 per vibe — that add up to rewards like gift cards.

4. Zip Pay (formerly known as QuadPay) lets you buy now and pay later at any store that accepts Visa.

Sign up for Zip and link your credit or debit card to be able to pay with a “ghost” Visa card. Not only can you use it for online purchases through the Zip app, but you can also use your card for in-store purchases anywhere Visa is accepted.

All purchases are split into four payments, scheduled over a six-week period, and are linked to your preferred credit or debit card.

There’s no credit check and no fees or interest when the payments are made on time.

5. Amazon has their own buy now, pay later option that lets you divide some purchases into five installments.

For certain new products sold and shipped by Amazon.com — mostly including new/refurbished Amazon devices — they’ll let you divide your payment into five installments with a credit card you have on file in your Amazon account.

The first installment is due the day the order ships, with four more payments coming every 30 days until the final payment is made 120 days from the shipment date. You can pay more than the requested amount or pay off your order early if you want.

There’s no charge to use this service, and no credit check or application is required. That’s a big deal. Learn more about Amazon’s monthly payment terms.

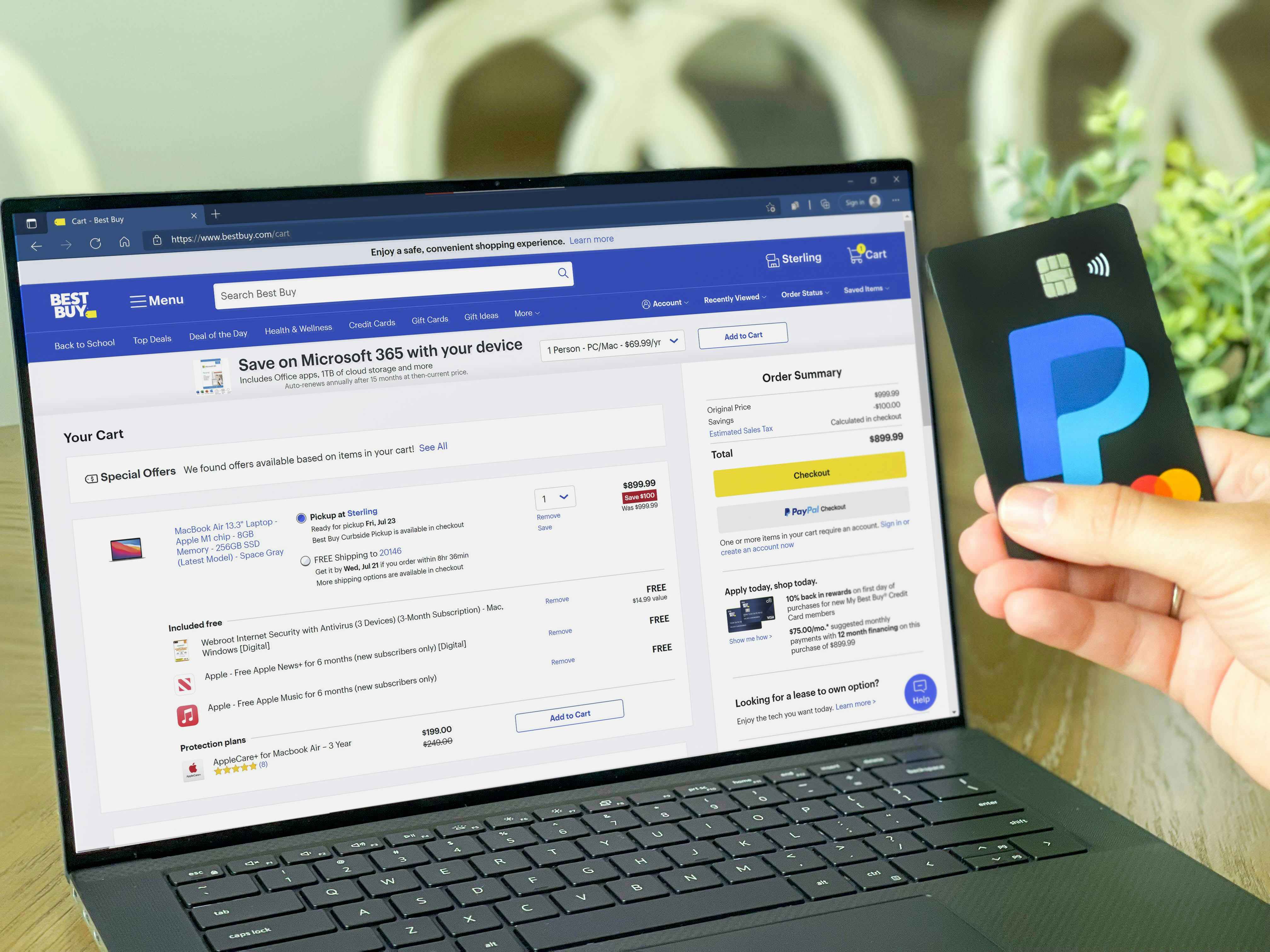

6. PayPal ‘Pay in 4’ lets you divide payments at any store that accepts PayPal.

The granddaddy of online payment options, PayPal, announced their new “Pay in 4” service in 2020.

You can use the service on purchases between $30 and $600. Like other Buy Now, Pay Later services, there’s an up-front percentage payment, then the remainder is split between three more interest-free automatic PayPal payments (connected to your bank account) over six weeks.

And in August 2021, they announced that there won’t be any late fees due to nonpayment.

PayPal has the advantage of being accepted at the vast majority of online retailers, as well as many physical store chains, including:

- Abercrombie & Fitch

- Advance Auto Parts

- Aéropostale

- American Eagle

- Barnes & Noble

- Dollar General

- Famous Footwear

- Foot Locker

- Guitar Center

- The Home Depot

- Jamba Juice

- JCPenney

- Nine West

- Office Depot

- Rooms To Go

PayPal’s other “Buy Now Pay Later” options — such as PayPal Credit and Easy Payments — are still available.

7. Sezzle stores include Target and GameStop.

Sezzle is a split-it-into-four-payments service that has a network of online partner retailers including Target and GameStop. You can either shop Sezzle stores via the app or check out using Sezzle during the checkout process at one of the retailers’ websites.

You get an instant decision once you apply for Sezzle (with no credit check). You’ve gotta set up your payment method so they can automatically withdraw your payment every two weeks: from your credit card, debit card, Google Pay, or Apple Pay.

8. Four accepts Google and Apple Pay for installment payments.

Four is a split-it-into-four-payments service that allows you to shop through their apps or check out with Four during the checkout process at one of the participating retailers’ websites.

No credit check is required, and you get an instant decision when you apply for Four. Set up your payment method and they’ll automatically withdraw your payment every two weeks: from your credit card, debit card, Google Pay, or Apple Pay.

9. SplitIt gives you more time to pay — up to 24 interest-free installments.

If your favorite online retailer accepts SplitIt, you can divide your payments up into monthly payments between 3 and 24 months.

Just select SplitIt at checkout, input your preferred payment card, and set up the repayment plan to complete your purchase. Your card will be charged automatically, with no interest, credit checks, or late fees.

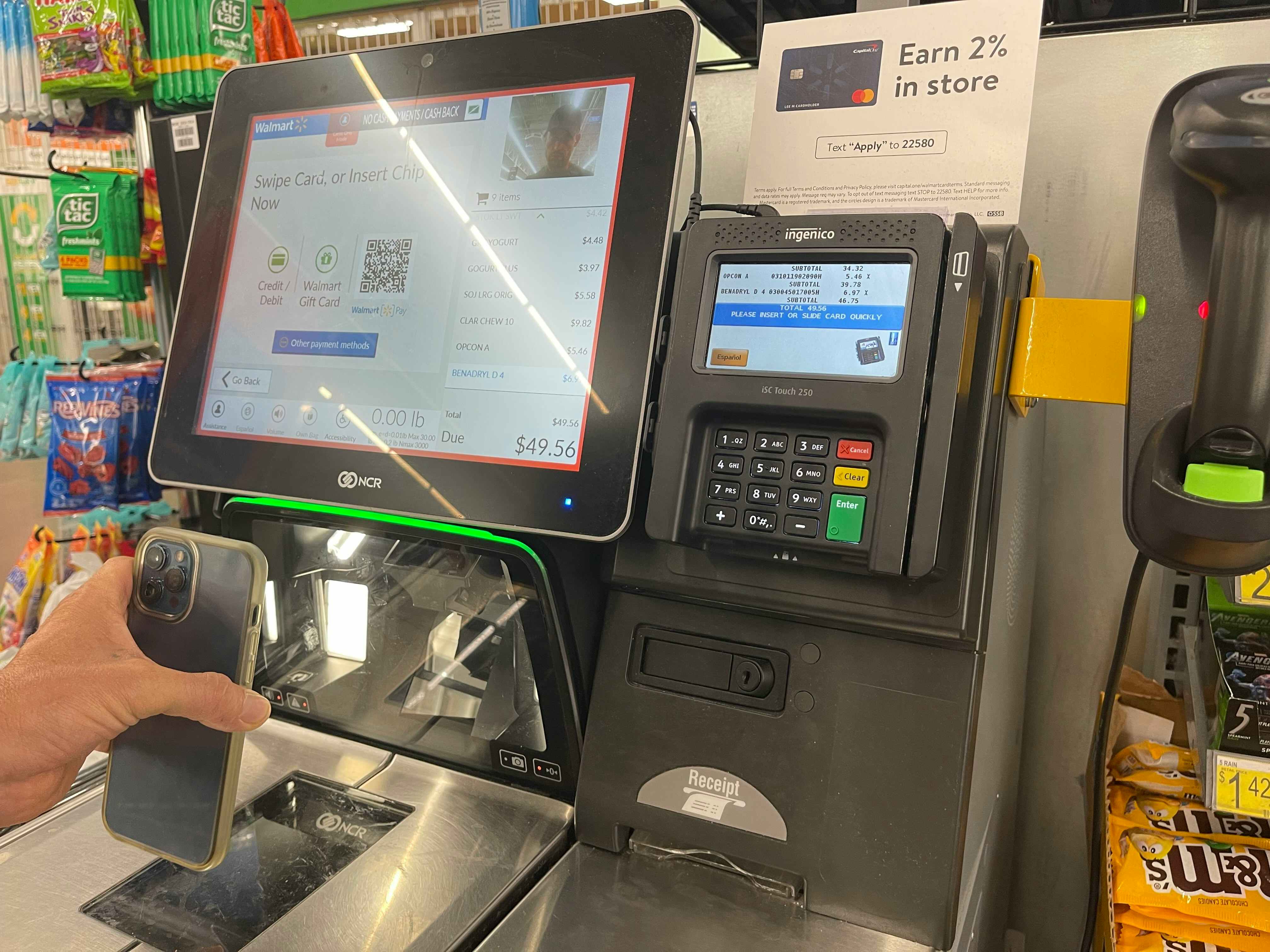

10. Affirm lets you set up payments for Walmart, Amazon, and more.

Like with SplitIt, you don’t have to specifically sign up for Affirm. What is Affirm? It’s a payment option at the checkout of hundreds of online retailers, including Walmart, Adidas, Purple, Peloton, Yeti, and Eddie Bauer.

Amazon recently announced a partnership with Affirm. In the coming months, Amazon will allow shoppers to pay for a wide range of products over the course of months, rather than weeks.

It’s not my favorite, though, because Affirm performs a credit check and charges interest. For example, Affirm’s partnership with Walmart offers repayment plans of 3, 6, and 12 months on purchases totaling $144 to $4,000 with interest rates that range from 10% to 36%.

If you’re shopping in person at Walmart, you sign up for Affirm and scan a special barcode from the Affirm app at the register to finish the transaction and begin the Affirm payment plan.

11. Zebit lets people with less-than-stellar credit pay over 6 months.

If you’re trying to avoid a credit check and spread out your payments beyond just four biweekly charges, Zebit is your go-to.

You get a spending limit of $1,000 – $2,500, and then you shop the Zebit marketplace, which contains more than 175,000 products, including electronics, kitchen, grocery, beauty, furniture, and more. After you make an initial 25% down payment, the rest of the balance is spread out monthly for six months at 0% interest.

12. Perpay takes their payments right out of your paycheck.

Buy now, pay later service Perpay doesn’t charge you interest, nor does a credit check — but what sets them apart from other BNPL providers is that you have to designate them as the recipient of your payroll direct deposit.

You choose how many payments you want to make over several months (with no interest or fees), and after you make your first payment, they’ll automatically take their payments out of your paycheck each payday (and make sure the rest goes in your primary checking account). And all the while, you build your credit.

Reviews for Perpay are mixed; people like the ease of making payments over time, but some say getting their purchases is pretty slow.

Those are the basics, but the market is being flooded with these Buy Now Pay Later services. If I’ve skipped one of your favorites, let me know in the comments!

Tell us what you think