Looking for the best online tax software in 2023? So much of finding the cheapest option is knowing your own situation. It’s important to consider your specific tax needs and the features that are most important to you. And of course, you want to find a program that will help you save money where you can.

For example, if you’re self-employed or have multiple sources of income, you’ll want a program that can handle complex tax situations and provide guidance for maximizing your deductions. On the other hand, if you have a simple tax return, you might be able to find a more affordable option. It’s also worth considering the level of customer support offered by the software, especially if you’re new to doing your taxes online. Some programs offer live chat or phone support, while others rely more on email or FAQs.

And last but certainly not least, think about the price but also consider any hidden fees such as state tax filing or additional forms. Ultimately, you want to find a tax software that fits your budget and provides the right level of support and features for your needs.

All of these factors will affect what the best software choice is for you. The good news is that the majority of people can file their federal returns for free, though sometimes you will end up incurring a fee for state taxes depending on your situation.

We’re going to help you figure out which option is the best (and cheapest) online tax software for you. Before we get into it, make sure you have The Krazy Coupon Lady app downloaded on your phone to receive money-saving deals every day.

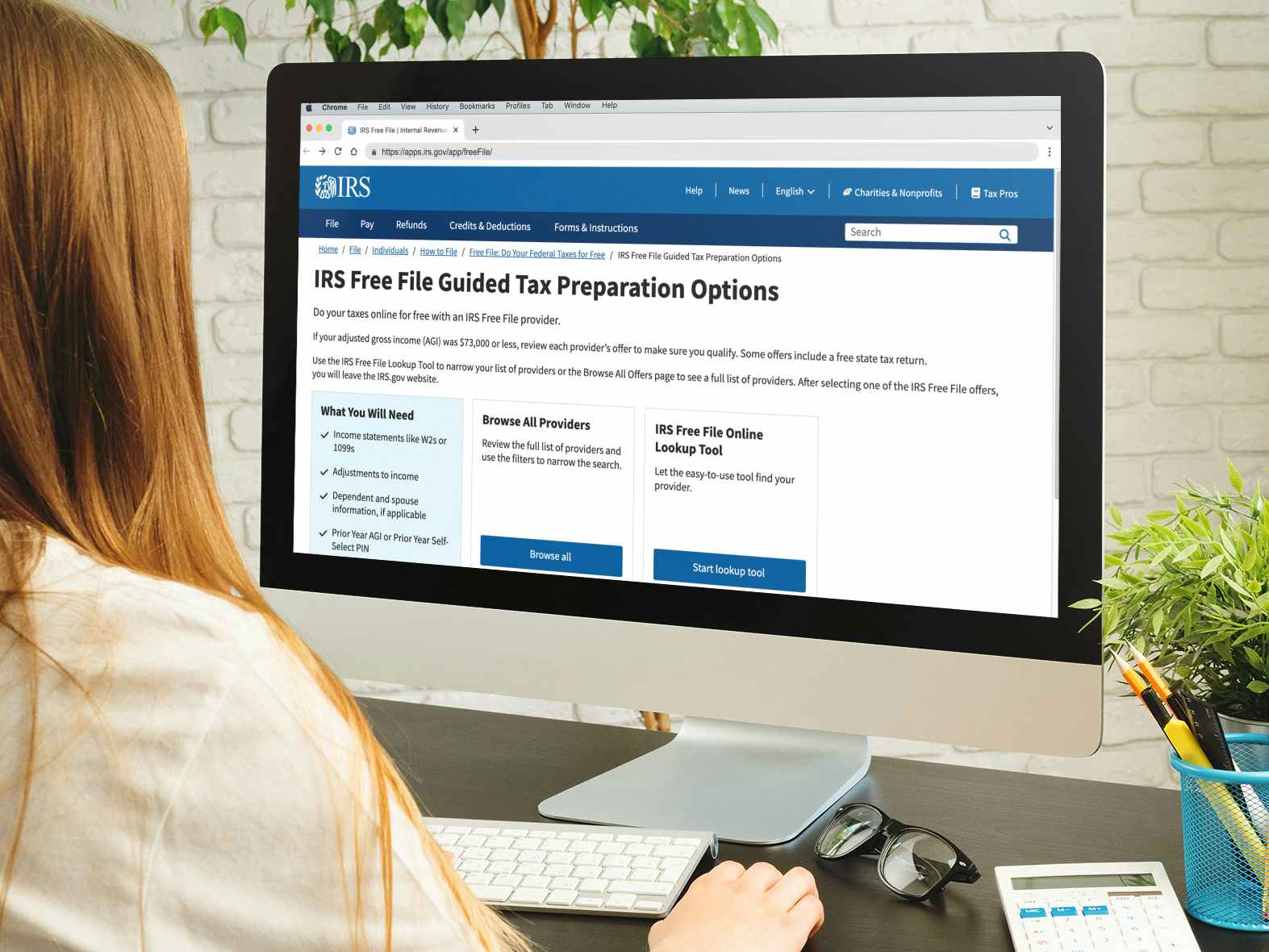

File your taxes for free with IRS Free File

Was your adjusted gross income less than $73,000 in 2022?

Then you qualify for the IRS’s Free File service! The IRS partners with various tax software providers to allow you to file your taxes for free, even if you’re self-employed. The Free File partners this year are:

- TaxAct

- TaxSlayer

- FreeTaxUSA

- OnLine Taxes

- FileYourTaxes

- ezTaxReturn.com

- 1040NOW Corp.

You can use the IRS’s tool to check your eligibility and find available software based on your situation, but be selective. Some of the options they show will not give you a state tax return for free, while others will. They’ll all give you free federal returns, but ideally you want to get the state return free, too.

As far as user experience goes, I’ve had the best luck with the first three services on the list. But prioritize getting the free tax state return if at all possible. You don’t necessarily need your tax software to be pretty. You just need it to work.

TIP: If your household makes $60,000-ish or less per year, you qualify for VITA. VITA is a way to get free, in-person tax services. It’s also available to the elderly or people who speak English as a second language regardless of income level.

Best and Cheapest Online Tax Services

Here are some of the top online tax services around. Depending on what you need, almost all of them have a cheap or free option.

Bear in mind that the prices listed below are base prices. Throughout tax season, you’re going to see a lot of sales, and those sales change very quickly. If you’re trying to decide between two different tax service providers and the only thing stopping you in your tracks is the price, visit their website to see if they’ve gotten more competitive in the last 24 hours.

TurboTax

| Base Price | Free if your only earned income was from a W-2 (1099-INTs and 1099-DIVs are also included.) Includes state tax returns, the Earned Income Credit, and the Child Tax Credit. |

|---|---|

| Self-Employed Price | $119 |

| Free File Partner | No |

| User Experience |

|

TurboTax Pros

Just a few years ago, I would have laughed if you had asked me whether a tax software assistance company would provide free, live assistance to people filing simple tax returns. But that’s exactly what TurboTax is doing this year with TurboTax Live Assisted Basic. The only catch is you have to file your taxes by March 31, 2023.

TurboTax is known for having an extremely intuitive user experience, with extensive written guidance throughout should you need it. It’s also easy to upload your W-2 and other tax forms, whether they were delivered digitally or you snap a pic of your paper form.

TurboTax Cons

The free version of TurboTax is great, but it doesn’t include much. If you need to file any additional Schedules with your 1040 outside of the Child Tax Credit, student loan interest deduction, and Earned Income Credit (EIC), you will need to use the Deluxe $59 version. If you’ve got crypto, you’ll need the next largest package which costs $89.

Self-employed people who file Schedule Cs and/or have 1099-NECs or 1099-Ks will need the self-employed package, which costs $119.

And that’s not even including the extra $59 fee for e-filing state taxes with these packages.

TurboTax is one of the best services, but if you require anything beyond basic, you’ll be paying a premium for it.

H&R Block

| Base Price | Free if your only earned income was from a W-2. Includes free state tax returns, the EIC, the Child Tax Credit, and various student deductions tied to form 1098-T. |

|---|---|

| Self-Employed Price | $115 |

| Free File Partner | No |

| User Experience |

|

H&R Block Pros

H&R Block’s user interface is easy enough to use, with written guidance along the way should you need it. You can easily upload your documents via a photo or import digital tax documents.

H&R Block’s free version is particularly attractive because it offers access to college-related tax credits. We’re not just talking student loan deductions. We’re also talking about things like the American Opportunity Credit for people currently paying tuition.

The self-employed price ($115) comes with free state tax filing.

H&R Block Cons

If you want live assistance through H&R Block’s online service, you’re going to have to pay for it. Packages start at $60.

While you’d have to try hard to incur a fee for preparing your state tax return to print and mail yourself, you will incur a $40 – $50 fee for e-filing your return in states that allow electronic filing.

FreeTaxUSA

| Base Price | $0 + $14.99 for state tax return |

|---|---|

| Self-Employed Price | $0 + $14.99 for state tax return |

| Free File Partner | Yes |

| User Experience |

|

FreeTaxUSA Pros

Unless you’re using the IRS’s Free File program, you’ll be hard-pressed to find a tax service that files all the extra schedules and forms at the federal level for a grand total of $0. Your options boil down to FreeTaxUSA and Cash App.

FreeTaxUSA does offer Free File, too, and if you use Free File, you can get a free state tax return regardless of which state you live in, which is a true rarity. But they make their eligibility rules a little funny. They’re supposed to be open for everyone with an AGI of $73,000 or less, but FreeTaxUSA only does this for military families. Everyone else has to have an AGI of $46,000 or under.

FreeTaxUSA isn’t as fancy as TurboTax or H&R Block, but its user interface does still provide detailed guidance along the way. Explanations for various credits and deductions are included.

FreeTaxUSA Cons

Unless you’re using Free File, you will always have to pay for state returns with FreeTaxUSA. While that is a con, it’s not the worst con ever. State tax returns cost only $14.99 to file, which is a pretty low rate if you have to pay anyways.

One pain point with FreeTaxUSA is that you’ll have to manually enter all the data from your W-2s, 1099s, and other tax documents. There’s no option to import digital documents or photos.

Live customer service isn’t free like it is with TurboTax, but the fee is relatively low at just $7.99.

Cash App Taxes

| Base Price | $0 + $0 for one state tax return |

|---|---|

| Self-Employed Price | $0 + $0 for one state tax return |

| Free File Partner | No |

| User Experience |

|

Cash App Taxes Pros

Cash App found a way to make their tax services even cheaper than FreeTaxUSA. It’s exactly zero dollars to file your first federal and state tax return every year, even if you’ve got a complex tax situation like self-employment. No Free File required. There are very few circumstances the free Cash App Taxes service can’t handle. Learn about them here.

If the only tax form you have is a W-2, you can easily input it via a photo. This is a really good way to file for those who want to use a mobile app rather than doing it on a desktop. Make sure you download the Cash App app. You’ll find Cash App Taxes inside.

Cash App Taxes Cons

You can file your taxes for free as a self-employed person or freelancer with Cash App. But it’s going to be a little more cumbersome than if you had a traditional employer. You’ll have to manually input all the information from your 1099s.

Cash App Taxes has a great user interface when you’re using the mobile version, but things can get a little clunky if you try to use it on desktop.

Another big negative mark for Cash App Taxes is that there are zero opportunities to get professional tax support. There is a free, live technical support team, but that’s for issues with the app, not IRS-related questions.

Related: 12 Deals on Tax Day That’ll Get You Free Food and Discounts

Jackson Hewitt Tax Service

| Base Price | $25 + as many free state tax returns as you want |

|---|---|

| Self-Employed Price | $25 + as many free state tax returns as you want |

| Free File Partner | No |

| User Experience |

|

Jackson Hewitt Pros

If for some reason you do want to use Jackson Hewitt online tax software over Cash App Taxes as a self-employed person, the $25 fee you’ll pay is lower than you would with other services like TurboTax or H&R Block. The level of in-software support is somewhere between a highly contextual TurboTax and a relatively low-context Cash App Taxes.

If you need to file multiple state tax returns, Jackson Hewitt might be the best fit if you don’t need a ton of support. There’s no charge for state tax returns; just the flat $25 fee.

Jackson Hewitt Cons

If you have a simple tax situation or qualify for Free File, there’s really no reason to pay the $25 fee for Jackson Hewitt. You can file for free elsewhere. The biggest exception is if you need to file multiple state tax returns. Jackson Hewitt charges $0 for any number of state tax returns.

Jackson Hewitt only provides the ability to import W-2s from select partner employers. The vast majority of people are going to have to manually input all the data from their tax forms.

Just like Cash App Taxes, Jackson Hewitt provides live product support but no live access to tax professionals through the tax software. The difference is that you can file live in person with human support at Jackson Hewitt at a number of physical locations, including inside a lot of Walmart stores. You’ll incur fees for these services, though.

TaxSlayer

| Base Price | $0 including free state returns for simple tax filers |

|---|---|

| Self-Employed Price | $64.95 + $39.95 for state returns |

| Free File Partner | Yes |

| User Experience |

|

TaySlayer Pros

The first big pro is that TaxSlayer is an IRS Free File partner. That means nearly half of American households (complex tax situation or not) can file a free $0 return with TaxSlayer. However, if you go this route, you may have to pay for your state tax return. Most states are still free through Free File, but with TaxSlayer, my home state of Pennsylvania is not.

If you have a simple tax situation where you’re only filing with W-2s, you can use the Simply Free package to get free federal and state tax returns regardless of income.

If you are paying for the full self-employed package, you will have access to live support from a tax professional. In-software support and user experience is pretty good. It’s not as intensive as other services like TurboTax, but it’s also not as expensive.

TaxSlayer Cons

Unless you qualify for a free state tax return through Free File or the Simply Free Package, your state tax return is going to cost you a lot. Thirty-nine whole dollars and ninety-five cents.

You also don’t have access to live support from tax professionals unless you pay for one of the more expensive packages.

Regardless of which package you choose, you’re going to have to manually input the information from your tax forms, like your W-2s and 1099s.

TaxAct

| Base Price | $0 + $39.95 for each state tax return Includes Child Tax Credit and EIC |

|---|---|

| Self-Employed Price | $94.95 + $54.95 for each state tax return |

| Free File Partner | Yes |

| User Experience |

|

TaxAct Pros

TaxAct is another Free File partner, which means you can file for free if your AGI is under $73,000. Again though, not all states get free returns with TaxAct through Free File. Most do, but a handful don’t.

TaxAct provides a level of in-software guidance equivalent to TurboTax for a lower (though still not super cheap) price, with an intuitive user interface. Plus, it offers free access to tax experts regardless of how much you pay — a service matched only by TurboTax.

TaxAct Cons

TaxAct’s state tax returns are a bit pricey. If you qualify with a super simple tax return for $0 federal filing, you’ll still pay $39.95 to file your state taxes. If you have a bigger package, like the self-employed package, you’ll pay an even higher rate of $54.95.

While there is a free option available for those who have simple tax returns, it’s limited. For example, you can use this package to file for the Child Tax Credit but not the Child and Dependent Care Credit. To get access to the larger package of credits and deductions, you’ll have to cough up some cash (unless you’re using the Free File program).

Like Jackson Hewitt, you can’t import your tax documents into TaxAct digitally — unless you get lucky and happen to work for the right employer. You’ll probably be manually inputting all your W-2s and 1099s.

Tell us what you think