When you want to stop blowing away money and start saving more, downloading a budgeting app is a great way to reach your financial goals. Sure, you can always balance your bank account on a piece of paper or spreadsheet. But the best budgeting apps come designed with features like bill reminders, options to categorize your spending so you know how much money goes where, and permission to collaborate with others.

With just a few clicks, you get a big picture of what your expenses and spending habits look like. Plus, you can see the details of how much you save every month. Scroll down to learn more about which best budgeting apps are the best choices to help you spend less. And if you want even more features, we’re including a few paid budget apps that come with free trials.

To stay up to date on the latest deals, download The Krazy Coupon Lady app so you never miss out on the latest money-saving hacks and discounts. Or you can text HACKS to 57299.

The Best Budgeting Apps of 2023

- Mint (Best All-In-One Budget App)

- Personal Capital (Best App for Investing)

- Digit (Best Smart Budget App)

- Pocketguard (Best App for Compulsive Shoppers)

- Honeydue (Best App for Couples)

- YNAB (Best App for Zero-Based Budgeting)

- Fudget (Best Simple Budget App)

- Every Dollar (Best for Managing Big and Small Expenses)

1. Mint

Best All-In-One Budget App

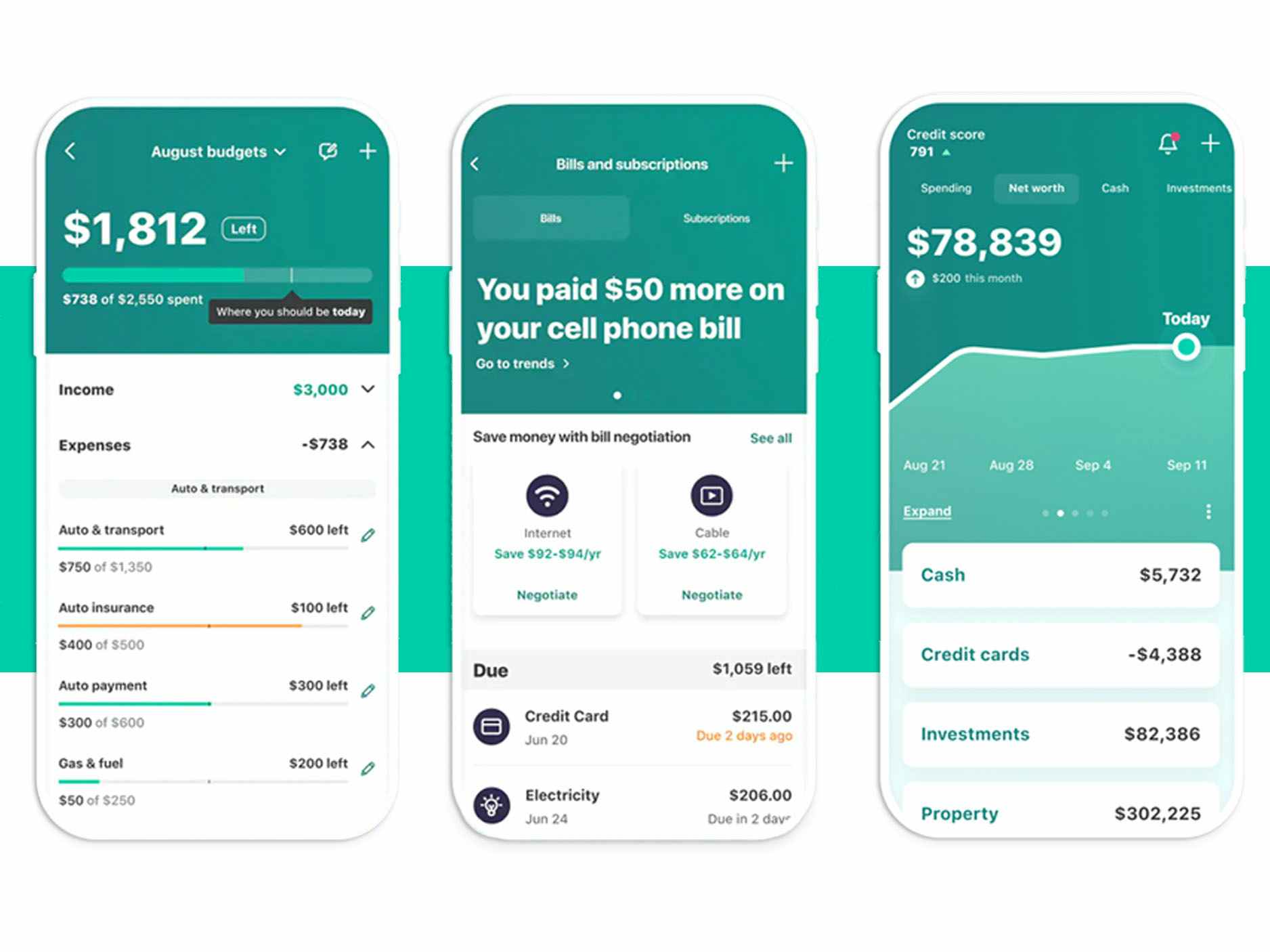

When it comes to finances, Mint (free) works well with probably every kind of budgeter out there. The app is owned by Intuit, the same company that owns Turbo Tax. It’s totally free, and there is no paid option available for people to use.

This app leaves no stone unturned when it comes to your money. In addition to its useful budgeting tools, it can keep track of your credit score, assess your net worth, plus give you sound financial advice on what you could do with extra cash. And it has a built-in debt tool that automatically tracks your debt payments. The only issue I have with the app is that it’s designed for individual use only, which is limiting if you’re balancing your budget as a couple.

Related: How to Spend Less Money in Every Area of Your Budget With Our 100 Tips

2. Personal Capital

Best App for Investing

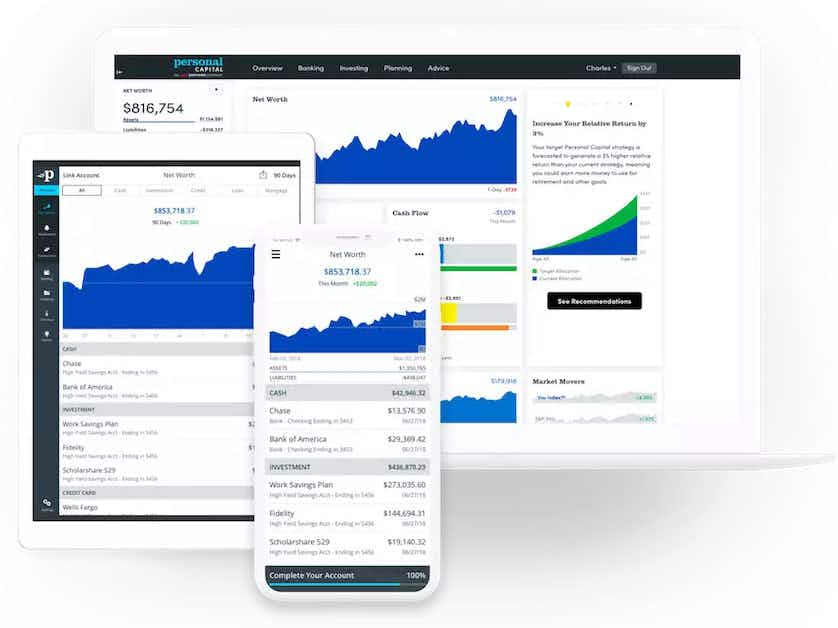

Among budget apps, we consider Personal Capital (free) as one of the OGs. This well-known app lets you manage your money through a dashboard that shows how your expenses stack up. It helps monitor your income from bank accounts and any investments you have in your portfolio. You then get a monthly spending report so you can see where your money is going.

Personal Capital works a little differently from other apps because of its built-in investment tool. This feature is highly beneficial if you have a 401K or own stocks. It also features a retirement planner, a fee analyzer that shows you where you can find hidden fees in your mutual funds, plus a net worth tracker. And the best part is that it’s all completely free.

3. Honeydue

Best Budget App for Couples

Honeydue (free) is one of the only apps I’ve seen that’s specifically designed for partners to manage their money together.

Through the dashboard, you can share all your spending information between you and your partner. But at the same time, you can use privacy settings to keep certain expenses to yourself. There’s also a chat window where you can send a message or emoji if you want to know more about a particular bill. Overall, it’s a good app for tracking daily expenses but doesn’t have advanced features like credit tracking and insights. Although it’s completely free to download and use, Honeydue encourages you to tip them if you really like their services.

Related: Wedding Ideas on a Budget to Consider When Planning

4. Digit

Best Smart Budget App

Digit (free for the first six months, then $5/monthly) is a smart budget app that syncs with your bank account to help you save more. You can start with a 6-month free trial, but eventually, it costs $5 per month to use their service.

This is how it works: Digit uses AI to calculate your income, spending, and bills so it automatically knows how much to set aside daily in a separate Digit account. Before you know it, you’ve built up mad money to put towards your next vacation, rent, or rainy day fund.

If you’re concerned that you’ve just given up control of your entire account to a robot, trust me, you don’t have to worry. Your account is still in your hands. So you can pause transactions, set limits as to how much is moved from your account, and also move funds back into your main account any time you want.

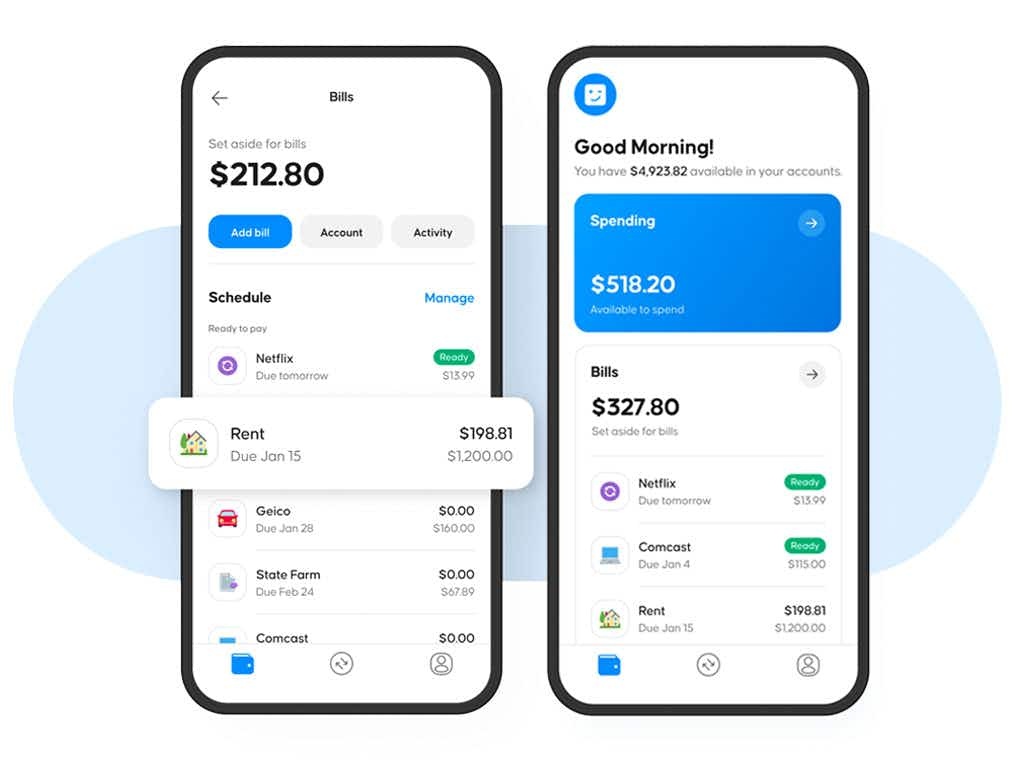

5. Pocketguard

Best App for Compulsive Shoppers

Just like the name implies, Pocketguard (free version available or paid version at $7.99/month) lets you track every penny so you can stash more money in your wallet. It builds a whole personal budget strategy for you based on your spending habits. It also lets you know exactly how much you’ve saved after you’ve paid the bills and everything else you’ve spent your money on.

We like that this app gives options in so many ways. You can organize your money in categories as well as create unique hashtags like #tvstreaming or #desserts so you get a custom report on the things you spend your cash on. You can also work the app by syncing it to your bank accounts, or if you would rather not, just calculate your budget without it.

Even though this app comes in both free and premium versions, we honestly think that you may be better off waiting to commit to the paid one. You can find most of the budgeting tools you need for free.

6. YNAB

Best App for Zero-Based Budgeting

If you feel your spending habits are out of control, consider the YNAB or You Need a Budget app (34-day free trial, then $14.99/month). This app is known for its zero-based budgeting philosophy that makes you put every dollar in a category so you know exactly where your money is going. YNAB also offers plenty of tools on their app to help you save money, which is great. At the same time, it can be overwhelming if it’s your first experience using a budgeting app. We like that the app fosters a sense of community. They have an educational blog as well as free, live classes to help you set up your budget if you’re a first-time user.

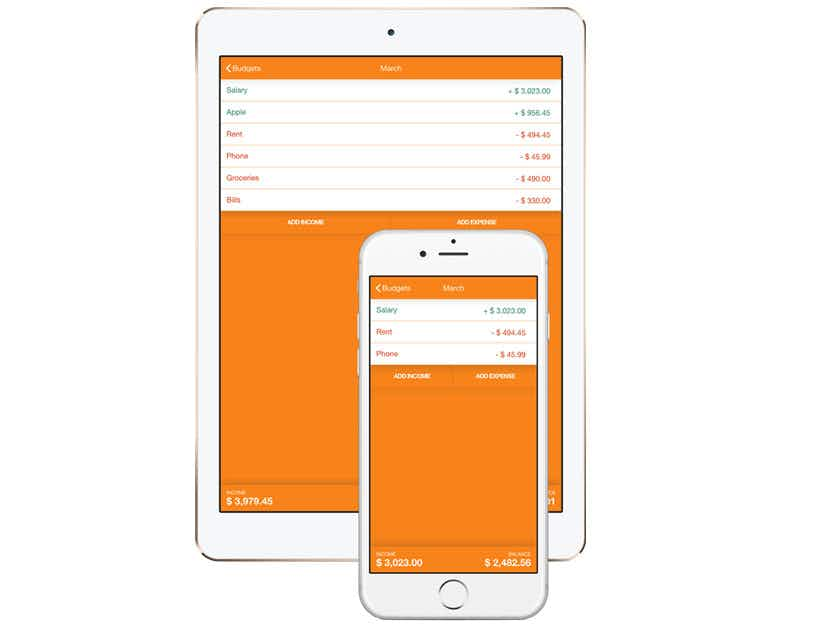

7. Fudget

Best Simple Budget App

The Fudget app (free version available, or $3.99 onetime fee for Pro version) is incredibly simple and easy to use. It’s great if you’re someone like me who doesn’t need plenty of bells and whistles to organize my budget. All you do is plug in your income and expenses so you can see the money you’ve spent for the month instead of having general categories like the other apps. Fudget doesn’t sync with your bank account either — which is a pro or con depending on what you’re looking for.

Use the free version, or if you don’t mind ponying up a few extra bucks, pay a $3.99 onetime fee for the pro upgrade. With that, you get no ads, a choice of jazzy themes for your background, and the ability to back up your financial deets to Dropbox.

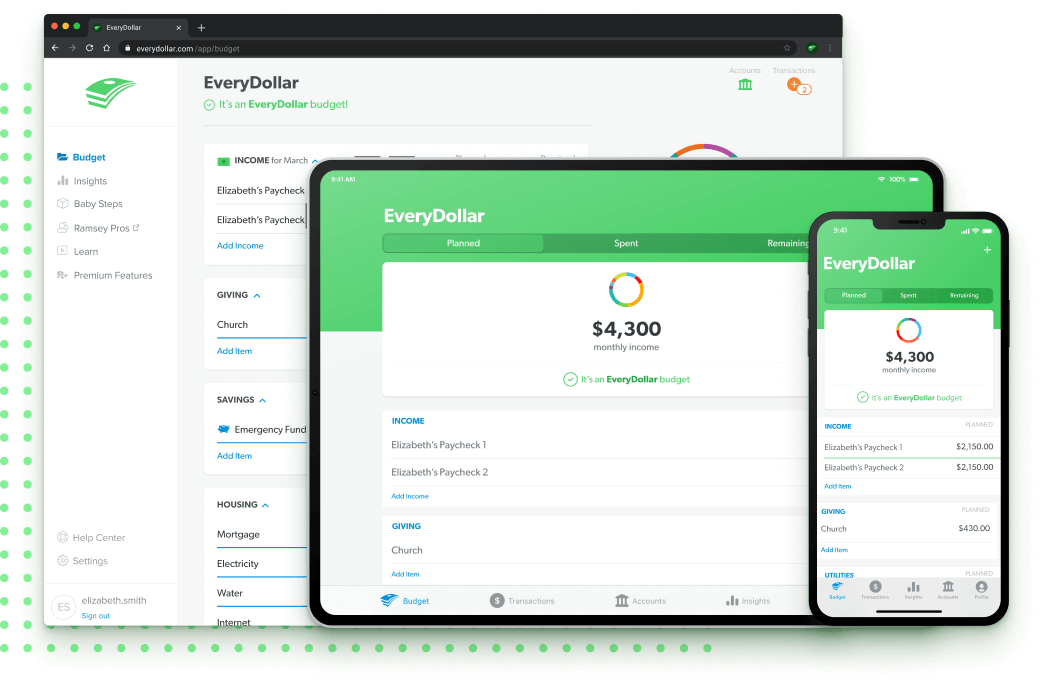

8. Every Dollar

Best Budget App to Manage Big and Small Expenses

If you want to budget just like popular finance guru David Ramsey, then you should consider the Every Dollar app (free for the first 14 days, then $12.99/month). This David Ramsey app is completely based on the principles of zero-based budgeting, which gives every dollar of your money a category or “home.”

Here, the budget categories are already set up and, might we add, completely automated. You only have to input your monthly expenses like rent or mortgage once. It also lets you create special sinking funds to track your money when you make large purchases, like a house. And if you buy the pro version, the app gives you advice based on your funds to help you build a better budget. Unlike other apps like Mint, which are geared toward individuals, Every Dollar is more family-friendly and allows you and a partner to share the same account.

Tell us what you think